AGAPES 2024 Dividend Calculator

$249

Facilitates the calculation of ISR and VAT for associations, with monthly and annual tabs that include exemptions by number of partners. Ideal for precise accounting management.

Product Description: AGAPE Calculator for Determining Dividends

This Excel calculator is designed for legal entities in the Agricultural, Livestock, Fishing or Forestry sector (AGAPES), allowing the precise determination of dividends with special tax treatment. The calculator takes into account the following specific situations:

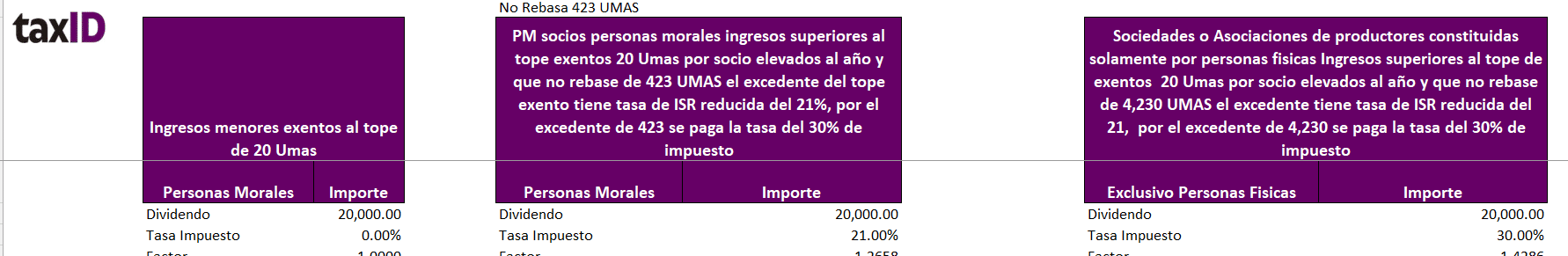

- Exempt Minor Income (Up to 20 UMAs per Partner):

- Automatically calculates dividends when income does not exceed the exempt limit of 20 UMAs per partner.

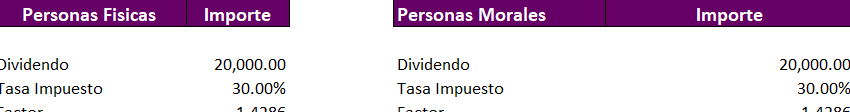

- Legal Entities (PE) with Legal Entity Partners:

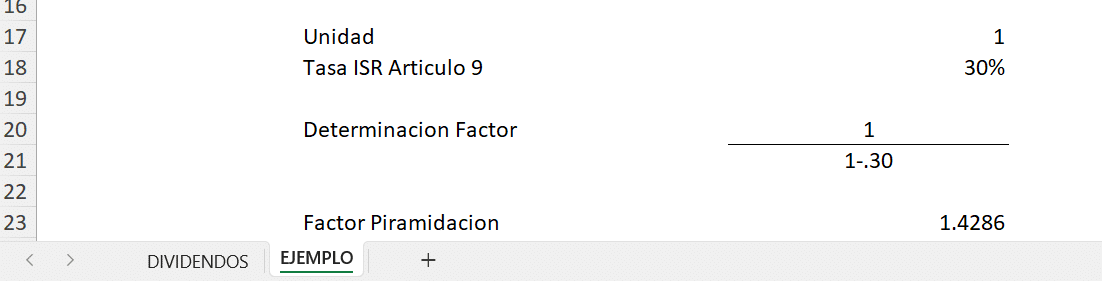

- For income exceeding the exempt limit of 20 UMAs per partner, raised to the year, and not exceeding 423 UMAs, the calculator applies a reduced ISR rate of 21% on the excess of the limit. For income exceeding 423 UMAs, the rate of 30% is applied.

- Producer Companies or Associations Formed Only by Natural Persons:

- In the case of income exceeding the exempt limit of 20 UMAs per partner, raised to the year, and not exceeding 4,230 UMAs, the calculator applies a reduced ISR rate of 21% on the excess. If income exceeds 4,230 UMAs, a rate of 30% is applied.

- Among Other Scenarios:

- The calculator also includes settings for other scenarios and specific tax situations that may affect the determination of dividends in AGAPES.

This tool is essential to optimize tax management at AGAPES, ensuring the proper calculation of dividends and compliance with applicable tax regulations.

Valoraciones

No hay valoraciones aún.