The NIF C-4, which deals with Inventories, establishes the rules for the recognition, valuation, presentation and disclosure of inventories in the financial statements. Its main objective is to provide standards that allow the appropriate value of an economic entity's inventories to be reflected, so that they are reasonably recognized in the financial results.

Key points of NIF C-4:

1. Definition of inventories:

Inventories are goods acquired or produced by an entity, either for sale in the ordinary course of its operation or for use in the production of other goods or services. They include:

- Goods purchased for resale.

- Raw materials, work in progress and finished products.

- Inventories of materials or supplies for consumption in the production process.

2. Valuation of inventories:

Cost of acquisition or production: Inventories should be valued at cost, which includes the cost of purchase, conversion costs, and other costs necessary to bring the inventories to their present location and condition.

Costing methods: Different methods are allowed to be used to value inventories, such as average cost, FIFO (First In, First Out) either identified cost.

3. Recognition of inventories:

Inventories are recognized when an entity obtains the inherent risks and rewards of the assets and they are expected to generate future economic benefits.

Inventories must be derecognized when they are sold or consumed in the production of other goods or services.

4. Deterioration or loss of value:

If the net realizable value (i.e. the estimated selling price less costs to sell) of inventories is less than their cost, impairment losses should be recognized.

5. Presentation and revelation:

Inventories should be presented as part of current assets on the balance sheet.

The valuation method used, significant movements in the value of inventories and any impairment losses or value adjustments must be disclosed in the notes to the financial statements.

Importance of NIF C-4:

This standard is essential for companies that have inventories, since proper records ensure that costs and financial results are realistic and consistent with the entity's activity. In addition, it directly affects the cost of sales and, therefore, gross profit, which is key for financial decision-making.

Practical case of the application of NIF C-4

A company called «ABC Marketing» is engaged in the sale of electronics. During the month of January, it purchased 100 units of a mobile phone model at a cost of $3,000 per unit. It also incurred additional transportation costs of $5,000 to bring the product to the warehouse. At the end of the month, the company sold 60 units.

Application of NIF C-4:

- Determining the acquisition cost: According to NIF C-4, the cost of inventories must include the purchase price further additional costs necessary for inventories to reach their current location.

- Purchase cost: $3,000 per unit.

- Transport: $5,000 (distributed among the 100 units).

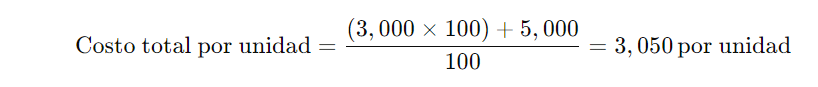

Therefore, the total acquisition cost per unit I would be:

- Inventory valuation: According to the costing method PEPS (First In, First Out), which the company has decided to use, the first units purchased are the first ones sold.

- Total acquisition cost of the 100 units: $305,000 (100 units × $3,050).

- 60 units were sold, so the cost of sales is:

- The 40 units remaining are kept in inventory, with a value of:

- Recognition in the financial statements:

- The cost of sales recognized in the income statement for the month of January it will be $183,000.

- The final inventory which will be presented at the balance sheet is $122,000, as part of current assets.

- Disclosure in the notes to the financial statementsIn the notes, the company must disclose the method used to value inventories (in this case, FIFO) and any other relevant details, such as significant movements in the value of inventories.

Summary:

- Cost of sales in January: $183,000.

- Ending inventory value on the balance sheet: $122,000.

This example shows how the company follows NIF C-4 to properly record its inventories, ensuring that both acquisition costs and additional costs, such as transportation, are accurately reflected in the value of inventories and in the cost of sales.

0 comentarios