Provisional Payments General Regime Title II – Excel

Simplify your tax calculations with our specialized tool!

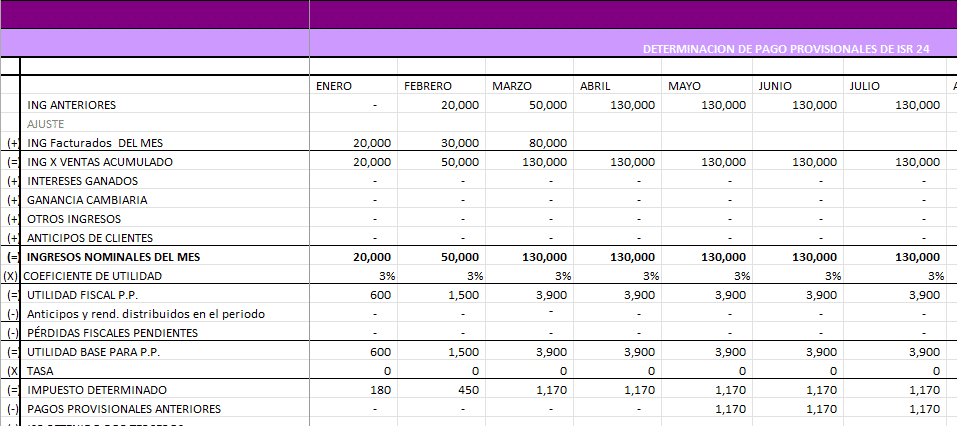

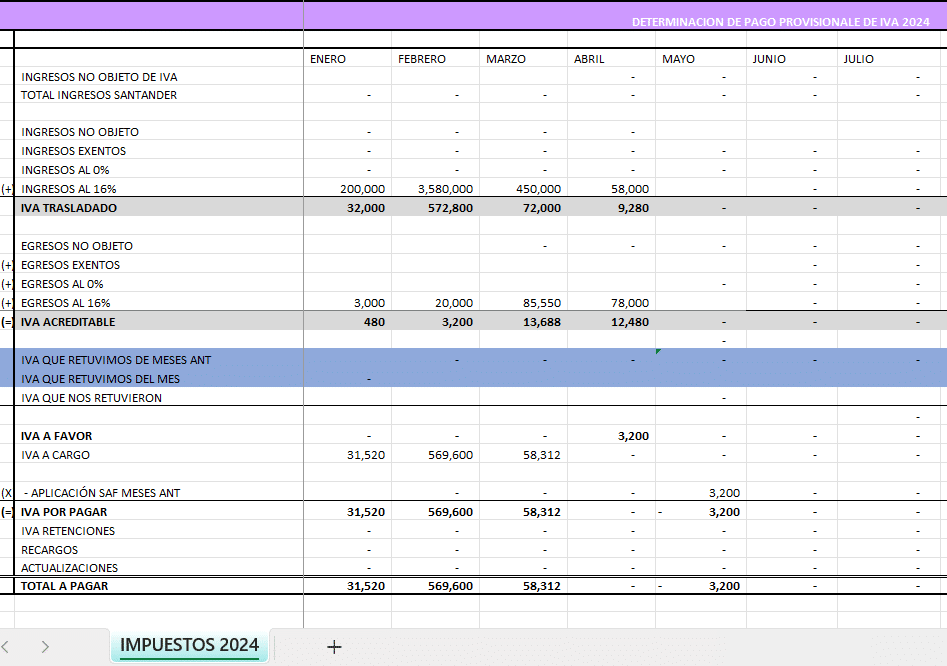

This Excel Work Paper It is specifically designed for Moral people under the General Regime of Title II. Facilitates the calculation and recording of your monthly provisional payments, taking into account income tax (ISR) and value added tax (VAT).

Main features:

- Automatic calculation of the ISR and VAT for each month of the fiscal year.

- Integration of accumulated income and authorized deductions in accordance with current legislation.

- Includes fields for credit provisional payments previous and applicable compensations.

- Intuitive interface to facilitate use for both accountants and business owners.

- Format ready for printing and sending to the SAT.

Ideal for keeping up to date with your tax obligations and Avoid errors when submitting your provisional paymentsWith this tool, you will be in total control of your tax obligations and improve the accounting and financial management of your company.

Valoraciones

No hay valoraciones aún.