Working Paper Provisional Payments RESICO Legal Entities

$699

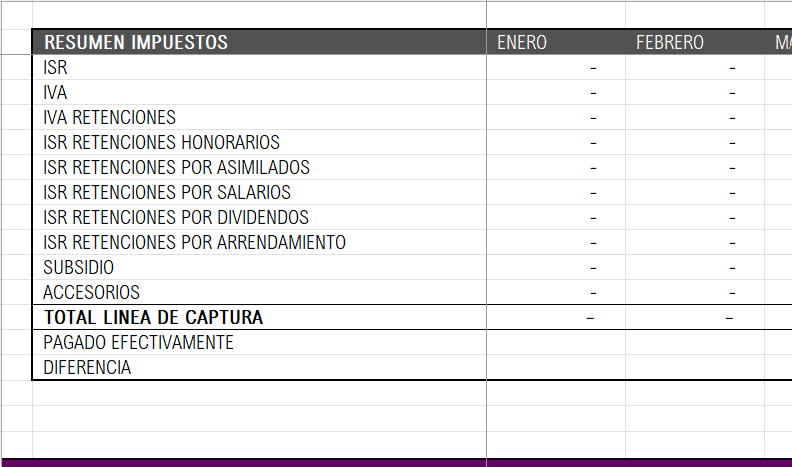

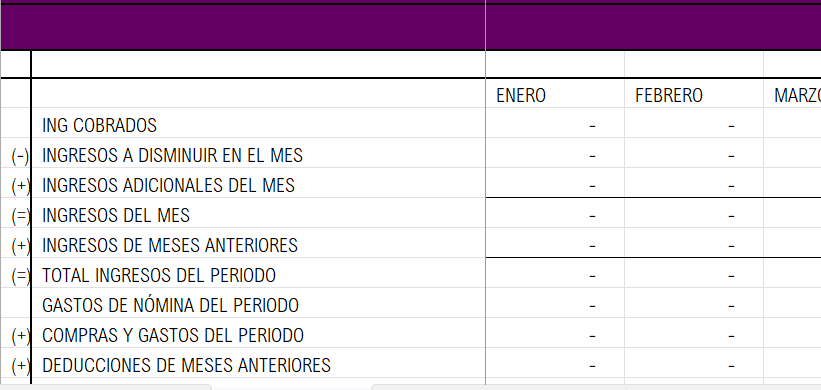

Simple template to calculate provisional payments of ISR, VAT and withholdings in the RESICO regime for legal entities, complying with the SAT.

RESICO Work Template for Legal Entities

This template is specifically designed to facilitate the calculation of provisional payments of ISR, VAT and withholdings for taxpayers of the Simplified Trust Regime (RESICO) in Mexico. It is ideal for legal entities seeking to comply with their tax obligations accurately and efficiently.

Characteristics:

- Automatic ISR calculation: Enter the deductible income and expenses for the period and obtain the provisional ISR amount to be paid quickly and easily.

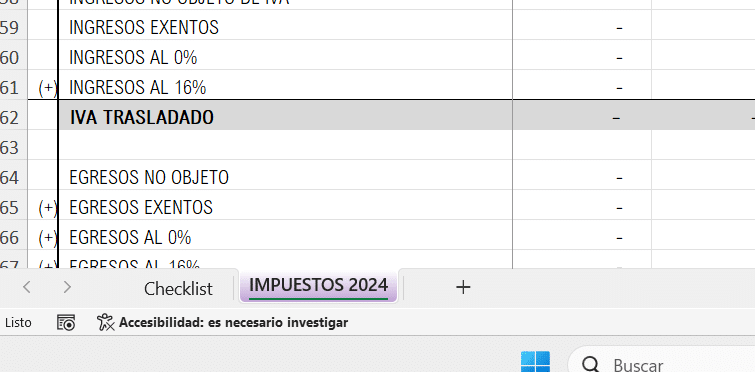

- VAT determination: The template includes the formulas necessary to calculate the transferred and creditable VAT, as well as considering payments and offsets.

- Income tax and VAT withholdings: Includes sections for recording and calculating income tax and VAT withholdings in transactions with third parties.

- Simplified tax compliance: Comply with SAT tax requirements, optimizing time and avoiding calculation errors.

- Friendly format: Easy to use and customizable to fit the needs of each company, with clear and organized sections.

This tool is essential for any accountant or company that wishes to simplify compliance with tax obligations under the RESICO regime.

Valoraciones

No hay valoraciones aún.