NIF B-2 allows two methods for the preparation of the cash flows: he straight (showing collections and payments) and the indirect, which is commonly used in Mexico.

The indirect method part of the accounting profit and adjust:

- Games that do not involve actual cash flow (such as depreciation and accrued interest),

- AND net changes in working capital (customers, suppliers, inventories and taxes).

This means that many figures in the flow should not be read literally as a payment or income, but as accounting movements accumulated during the period.

Case study: Example, SA

Cash flow analysis

Below we present an analysis prepared with the previous financial statement:

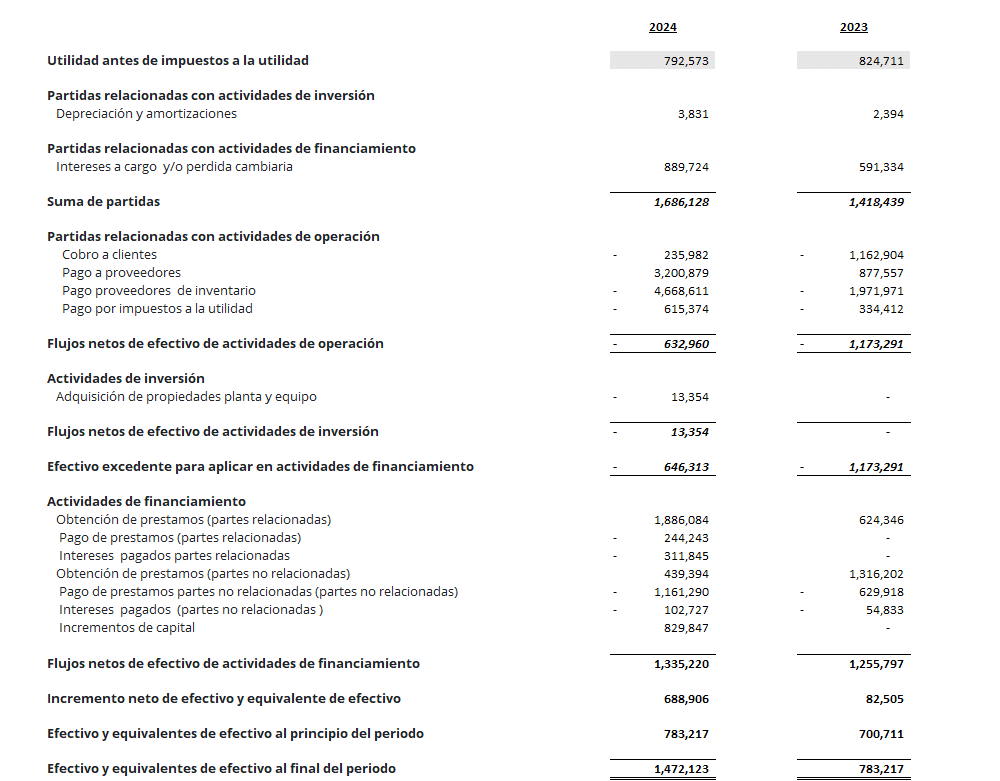

During fiscal year 2024, the entity reported profit before tax of 1TP4Q792,573, slightly lower than the previous fiscal year (1TP4Q824,711). Applying the indirect method, adjustments were made to items that do not involve cash movements, notably depreciation and amortization (1TP4Q3,831) and interest expense and exchange loss (1TP4Q889,724), resulting in a total of 1TP4Q1,686,128.

In operating activities, net cash outflows were observed mainly from payments to suppliers (1Q4Q3,200,879), payments to inventory suppliers (1Q4Q4,668,611), and income tax payments (1Q4Q615,374). Collections from customers were low compared to the prior year (1Q4Q235,982 in 2024 vs. 1Q4Q1,162,904 in 2023). As a result, net cash flow from operating activities decreased significantly to 1Q4Q632,960, compared to 1Q4Q1,173,291 in the prior year, reflecting pressure on operating working capital.

Regarding investment activities, the only outflow was the acquisition of property, plant and equipment for $13,354, which is marginal but represents a reinvestment in productive assets.

Regarding financing activities, the company offset the decline in operating cash flow with robust financing. It obtained loans from related parties and third parties, carried out capital increases of 1Q4Q829,847, and made corresponding payments and interest. Net cash flow from financing activities amounted to 1Q4Q1,335,220, higher than the previous year.

The net increase in cash for the period was 1Q4Q688,906, and the closing balance of cash and equivalents closed at 1Q4Q1,472,123, representing a growth of 881Q3Q compared to the end of 2023. Although liquidity at the close is positive, it is important to note that this was achieved primarily through financing received and not through internal cash generation.

From an accounting perspective, in accordance with the provisions of NIF B-2 "Statement of Cash Flows," the operating result shows a significant decline in cash generation, which could compromise sustainability in the medium term if the trend is not reversed. It is recommended to review the cash conversion cycle, improve collection policies, and evaluate the dependence on financing to cover recurring operations.

Cash Flow Conclusions

The cash flow statement is essential for assessing a company's actual ability to generate liquidity. In this case, it was identified that the majority of the cash generated during the fiscal year came from financing activities rather than from business operations. This is a red flag, as a healthy company must be sustained primarily by its operations.

To correct this situation, it is recommended to optimize the collection cycle, control supplier payments, and reduce dependence on external financing. It is also key to implement a monthly flow analysis and strengthen financial planning to anticipate capital needs and make informed decisions.

0 comentarios