One of the objectives of financial reporting is to make appropriate decisions that allow for increased profits for companies. The four basic financial statements play a fundamental role, and today we'll demonstrate this with a basic analysis of these statements for a real company, but without any names.

Below are the financial statements as of December 31, 2024, and 2023, of a company engaged in the importation and national distribution of products for sale to the general public:

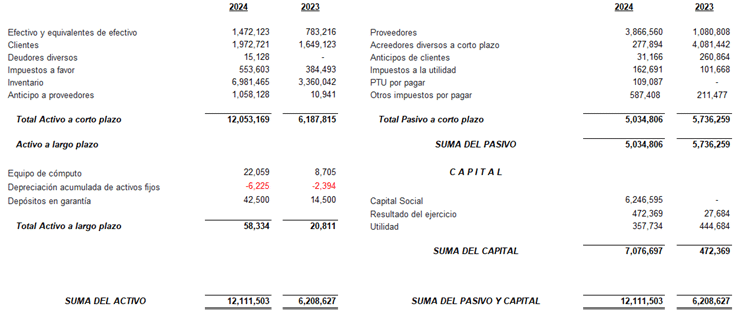

1) Statement of financial position:

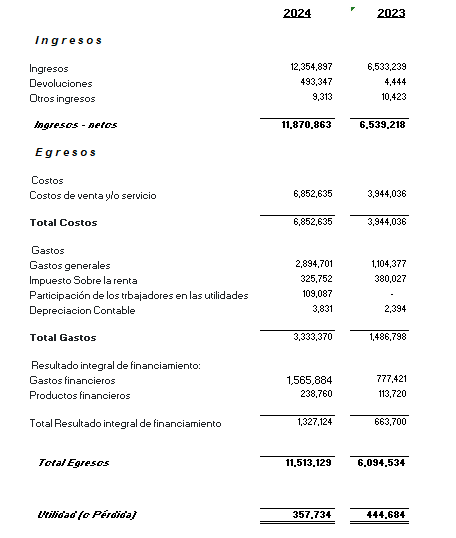

2) Income statement

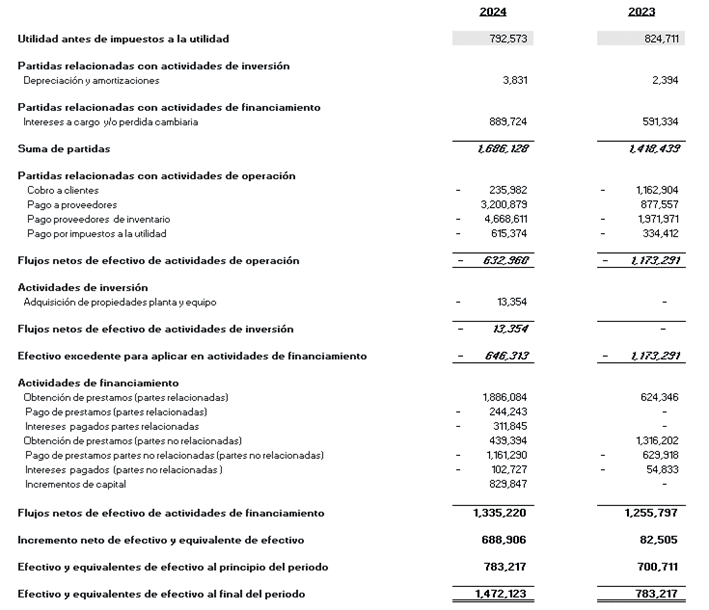

3) Cash flow statement

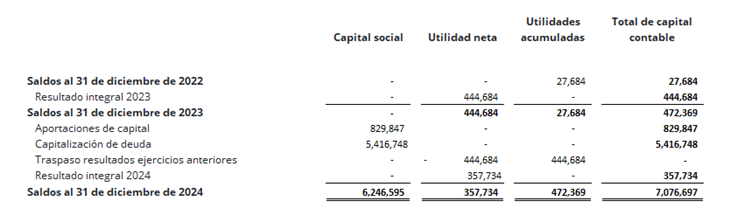

4)Statement of changes in shareholders' equity

Analysis of basic financial statements

Analyzing a company's financial statements allows us to evaluate its profitability, liquidity, capital structure, and cash generation capacity.

An integrated evaluation of the statement of income, statement of financial position, statement of cash flows, and statement of changes in shareholders' equity for the 2024 financial year is presented below.

Statement of income

During 2024, the company doubled its net income, going from 4Q16.5 million in 2023 to 4Q11.8 million. This growth was accompanied by a considerable increase in sales costs, which rose from 4Q13.9 million to 4Q16.8 million. However, the gross margin remained positive. General expenses tripled, especially in areas such as salaries, services, and operations, which is consistent with accelerated business growth.

The record of PTU (profit-taking) for 1Q4T109,000 is noteworthy, as is an increase in the income tax (ITR). Both reflect a company with higher taxable profits. The financial result was negative, with expenses of 1Q4T11.5 million compared to products of only 1Q4T238,000, indicating a high financial cost.

Despite these costs, the company closed the fiscal year with a net profit of Q4Q1357,734. Although lower than the Q4Q144,684 result for 2023, this result should be analyzed in conjunction with the evolution of the balance sheet and capital structure.

Statement of financial position

Total assets doubled, reaching 12.1 million pesos in 4Q1, driven primarily by increased inventories, cash, and advances to suppliers. Liabilities, in contrast, decreased from 5.7 million pesos in 4Q1 to 5.0 million pesos in 4Q1, highlighting a dramatic drop in various creditors, which can be interpreted as a repayment of liabilities or a restructuring.

The most significant growth was in shareholders' equity, which increased from 4Q1472,000 to over 4Q17,000,000, thanks to two key events: the capitalization of 4Q15.4 million and additional contributions of 4Q1829,000. This demonstrates that the growth observed in revenue and assets was financed not by debt but by equity, substantially improving the company's solvency.

Cash flow statement

Operating cash flow was positive but declining, going from 1TP4Q1.17 million in 2023 to just 1TP4Q632 thousand in 2024. This decline was primarily due to an increase in payments to suppliers and inventory, and a significant reduction in collections from customers.

Investment was minimal (4Q13,000 in fixed assets), consistent with a company that prioritizes operations over physical expansion. Financing was key: 4Q1.3 million in net cash flow from capital contributions and loans. This inflow allowed the company to close the year with a cash balance of 4Q1.47 million, practically double the previous year's closing balance.

Statement of changes in stockholders' equity

This statement confirms that the growth in share capital was due to two extraordinary movements: cash contributions and debt capitalization. In addition, retained earnings from prior years were incorporated. This reflects a strengthened financial structure and greater independence from external financing.

Possible improvement actions

1.Income Statement: Improved profitability and cost control

- Review and optimize overhead costsA significant increase in overhead costs was observed (from 1Q4Q1.1 million to 1Q4Q2.8 million). It is essential to analyze the expense by type (payroll, utilities, rent, travel expenses) to identify areas where these can be reduced without impacting operations.

- Evaluate the return policyReturns increased from 1TP4Q4,000 to 1TP4Q4,000. This may reflect quality issues, non-delivery, or administrative errors. It is recommended to establish more rigorous quality controls and sales documentation.

- Negotiate better financing conditionsFinancial expenses have doubled. It is suggested that interest rates be renegotiated, debt consolidation, or less expensive alternatives be sought (e.g., revolving lines of credit or government financing).

- Evaluate gross margin and pricing policyAlthough revenues grew, so did costs. It would be useful to calculate gross margins by product/service line and consider price adjustments or portfolio restructuring.

2. Statement of Financial Position: Sanitation of financial structure and liquidity

- Reduce inventory concentrationInventory nearly doubled (from 1Q4Q3.3 million to 1Q4Q6.9 million). It is recommended to implement inventory turnover indicators and adjust purchasing policies to avoid obsolescence or overstocking.

- Review customer balances and advancesAlthough customer balances decreased slightly, their aging should be monitored. The low operating cash flow may be related to overdue accounts receivable. It is suggested that automated reminders, late payment interest, and stricter contracts be implemented.

- Use advances to suppliers strategically: They increased from 10,000 to 10,000 million. Conditions must be renegotiated to convert them into effective inventory more quickly or defer them if the supplier fails to comply.

3. Cash Flow Statement: Focus on Genuine Operating Cash Flow

- Improve the cash conversion cycleOperating cash flow decreased from 1Q4Q1.1 to 1Q4Q632,000. The company must monitor the relationship between days of inventory, accounts receivable, and accounts payable. Tools such as a cash flow dashboard or implementing weekly KPIs will help identify bottlenecks.

- Avoid excessive dependence on financingAlthough the cash close was positive, it was achieved through debt and capitalization. In the medium term, this is not sustainable. We must seek healthier operating margins and self-financing.

- Plan asset purchases based on cash flows, not surplus capital.The fixed assets acquired are minimal, but they must be done with a strategic vision: Does it increase productivity, reduce costs, or generate revenue? If not, it should be avoided.

4. Statement of Changes in Stockholders' Equity: Consolidate structure and communicate confidence

- Leveraging the strength of social capitalCapitalization strengthens the financial structure, but it must be communicated to partners, clients, and financial institutions as a reputational asset. This can improve credit conditions and confidence in the operation.

- Establish a formal profit reinvestment policy: Since results from previous years have accumulated, it is recommended to define what percentage is reinvested, distributed, or reserved for contingencies.

- Properly document contributions and debt capitalizationFor tax and corporate purposes, it is essential to have minutes, contracts, and transactions formally registered with the SAT and the Public Registry of Commerce.

General conclusion

The company is experiencing accelerated growth, with revenues doubling and a significant increase in assets. However, net income is declining due to rising operating costs and financial expenses. The balance sheet reflects a clear improvement in the financial structure: liabilities are down, shareholders' equity is up, and cash is accumulating, all financed internally by partners rather than by third parties.

Although the operation generates positive cash flow, it still relies heavily on financing to maintain its liquidity. Improving operational efficiency, reducing financial costs, and focusing efforts on inventory turnover and accounts receivable will be key next fiscal year.

If you'd like a personalized analysis of your financial statements, to optimize your cash flow, or to evaluate your capital structure, please contact me at hgalicia@taxid.mx. At Tax ID Mexico, we help you make accounting and tax decisions based on real, actionable information.

0 comentarios