The NIFs are mainly divided into two large groups of regulatory pronouncements: the Conceptual Framework (CM) and individual NIFs.

In this article we will analyze the main differences in the MC compared to previous years.

Why is the NIF Series A updated?

The International Accounting Standards Board (IASB), the body responsible for issuing the International Financial Reporting Standards (IFRS) published an update on its 2018 MC, which is why CINIF considered it appropriate to update the MC of the NIF to adhere to the greatest possible convergence with international regulations.

Main changes in series A of the NIF

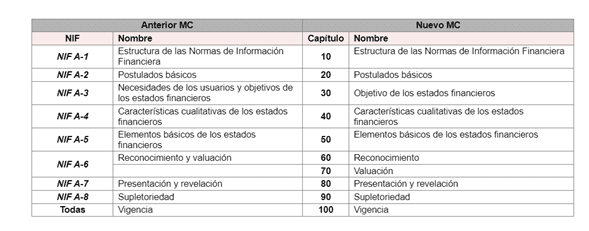

The NIF MC published in 2005 was made up of eight individual standards. During the update process, CINIF considered that including these individual standards in a single one would be more practical and functional, which would be NIF A-1 divided into 10 chapters.

Below is an image of the differences contained in NIF 2024:

Below are the main changes in each of the chapters of the MC of the NIF:

- Chapter 10 – Structure of the NIF: The mention of is incorporated “technical reports” which are guides to facilitate the application of the NIFs already established that refer to emerging issues of a temporary nature.

- Chapter 20 – Basic Postulates: The concept of accounting period that was associated with accounting accrual was integrated into Chapter 30.

- Chapter 30 – Objectives of financial statements: change name of “User needs and objectives of financial statements” now calling itself “Objectives of financial statements” under the logic that to meet the objectives of the financial statements we must understand the needs of the users of financial information

- Chapter 40 – Qualitative characteristics of financial statements: In this NIF, qualitative characteristics are divided into fundamental and improvement characteristics.

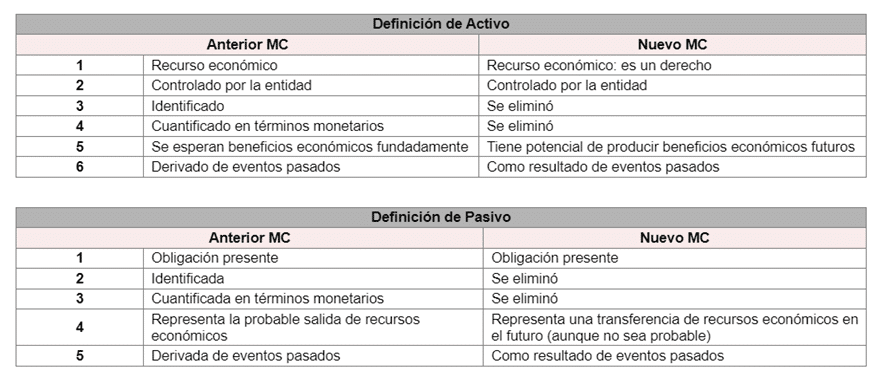

- Chapter 50 – Basic elements of financial statements: Adjustments are made to the definitions of assets and liabilities. Below is a comparative table incorporated in NIF 2024:

- Chapter 60 – Recognition: The concepts of initial recognition and subsequent recognition are modified to initial valuation and subsequent valuation.

- Chapter 70 – Valuation: A specific chapter is created for the topic of valuation of recognition. Mainly, the valuation basis of historical resources is eliminated as it is covered by the new valuation basis of amortized cost.

- Chapter 80 Presentation and revelation: The requirements related to effective communication are incorporated, defining it as that which increases and contributes to a faithful representation of the financial statements.

- Chapter 90 – Supplementary: No changes

Conclusions

We recommend that our readers study the MC of the NIF to obtain financial information that allows us to make appropriate decisions about an entity.

0 comentarios