According to the Financial Reporting Standards (NIF) the "utility" It is the fundamental characteristic that financial statements must have.

This characteristic is defined as:

“the quality of satisfying the common needs of users and constitutes the starting point for deriving the remaining qualitative characteristics…”

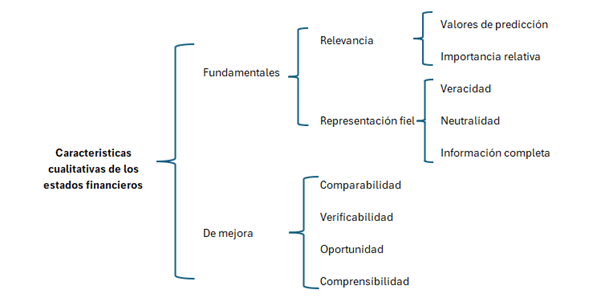

Classification of qualitative characteristics of financial statements

According to paragraph 4.1.1. of the NIF A-1, the qualitative characteristics are classified into:

- Fundamental qualitative characteristics (must be met without exception)

- Qualitative characteristics of improvement (highly desirable and met at their highest possible level)

Key features (relevance and faithful representation)

Qualitative characteristics fundamentals are:

- Relevance: This characteristic is met when the financial statements influence the economic decision-making of those who use them.

For financial statements to be relevant they must:

- Serve as a basis for making predictions and confirming them (prediction and confirmation values); and

- Show the most important aspects of the entity (relative importance).

- Faithful representation: Faithful representation occurs when the financial statements are consistent with their economic substance. For financial statements to be a faithful representation, they must:

- Correctly reflect transactions and other events that actually occurred (veracity)

- Finding yourself free from bias and prejudice (neutrality); Y

- Include all information that influences decision making (full information).

Qualitative characteristics of improvement

The qualitative characteristics of improvement are:

- Comparability: It establishes that similar issues should be seen as similar and different issues should be seen as different, so that the information is comparable.

- Verifiability: Financial information must be verifiable and validated.

- Chance: Financial statements must be issued in a timely manner before they lose their ability to influence decision-making.

- Compressibility: Financial statements should be easy for their users to understand.

Diagram of the qualitative characteristics of financial information

Below is a diagram for your better understanding:

It is important to mention that qualitative characteristics have cost/benefit ratio restrictions and balance between qualitative improvement characteristics.

Conclusions

To generate financial information for decision-making, it is essential to know the qualitative characteristics of the financial statements and apply them correctly.

Regardless of the size of the entity (company) we recommend our readers to evaluate the application of the NIF to generate financial information for decision making.

0 comentarios