The Financial Reporting Standards in its NIF C-2 They indicate different types of Financial Instruments, among those that cause the most confusion in my opinion are: Financial Instruments for Collection of Principal and Interest (IFCPI), Financial Instruments for Buying and Selling (IFCV) and Negotiable Financial Instruments (IFN).

The objective of this article is to provide the main differences between these financial instruments by analyzing aspects such as the objective, the generation of cash flows, business models, risk management, among others.

Definitions of IFCPI, IFCV and IFN according to the NIF

We will begin by pointing out the definition of the different types of Financial Instruments indicated in the NIF glossary:

- Negotiable Financial Instrument (NFI): It is any investment in financial instruments, and is made up of debt or capital financial instruments, the objective of which is to obtain a profit between the purchase and sale price and not to collect contractual cash flows for principal and interest, meaning that its management is based on the market risks of said financial instrument.

That is, a IFN It is an investment in financial assets, which can be debt or equity. Its main objective is to generate profits by buying at one price and selling at another, instead of obtaining regular payments for interest or capital. The management of these instruments is based on market risks, that is, on fluctuations in their purchase and sale value.

- Financial Instrument for Collecting Principal and Interest (IFCPI): An IFCPI is a loan whose objective is to collect contractual cash flows; the terms of the contract provide for cash flows on pre-established dates, which correspond only to payments of principal and interest on the outstanding principal amount. Therefore, the IFCPI must have loan characteristics and be managed based on its contractual performance.

In other words, a IFCPI It is a loan whose objective is to receive payments agreed upon in the contract, which are made on specific dates. These payments include the initial capital and the interest generated on that capital. Basically, it works like a loan and is managed according to the returns agreed upon in the contract.

- Financial Instrument to Collect or Sell (IFCV): It is a financial instrument whose objective is to collect contractual cash flows for principal and interest, and obtain a profit on its sale when this is convenient.

A IFCV It can also be defined as; an asset whose purpose is to receive principal and interest payments as agreed, but can also generate profits if sold at the right time.

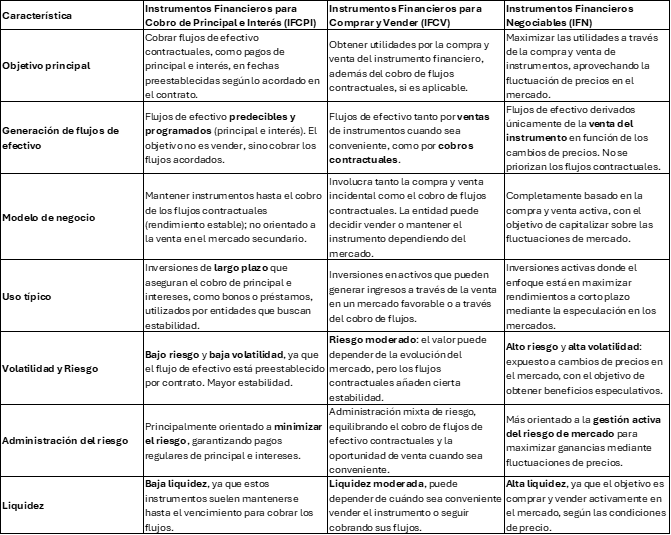

Comparative table of IFCPI, IFCV and IFN

Below is a comparison table of the different types of investment instruments defined in this article for a better understanding:

The importance of identifying the type of investment instrument that the entity is using lies in making correct decisions on how said instrument will be valued, presented and disclosed in the financial statements.

The above is crucial, as it affects both the measurement of financial results and the information provided to users of financial statements for proper decision-making.

Conclusions

Correct classification of financial instruments is key to ensuring transparency and accuracy in financial statements, allowing the entity to value and present them appropriately. This ensures that users understand the risks and returns associated with investments, while facilitating informed decision-making and regulatory compliance, aligning the management of financial assets with business objectives.

0 comentarios