The Financial Reporting Standards (NIF) They indicate that financial statements are the structured representation of the financial situation at a given date, and of the operating results, the changes in the equity of an entity, said financial statements present information of an entity that is useful in the process of making its economic decisions.

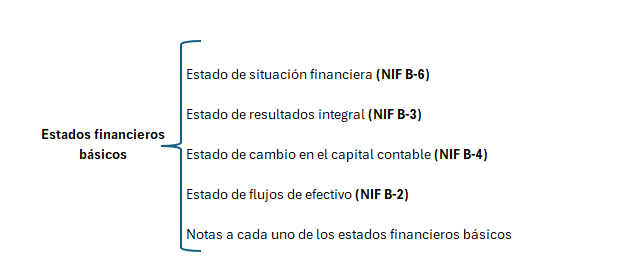

For a for-profit entity, the basic financial statements consist of:

Objectives of basic financial statements

NIF A-1 In chapter 30 it states that the objective of financial statements is provide financial information about the entity to existing or potential users for making economic decisions in relation to the entity.

Considering the common needs of users according to the NIF, the financial statements must be useful, for example:

- Making investment decisions in entities.

- Making decisions about granting credit.

- Evaluate an entity's ability to generate resources or income from its operating activities.

- Form a judgment of the entity's management and evaluate its administration.

NIF A-1 also states that financial information must provide indicators on:

- Solvency or financial stability.

- Liquidity.

- Operational efficiency.

- Financial risks: market risk, credit risk, liquidity risk and cash flow risk.

- Profitability.

Limitations on financial statements

NIF A-1 also establishes the limitations to the financial statements that users must take into account, which are mentioned below:

to) Transactions and other events that economically affect the entity are recognized according to specific standards that can be applied with different methods, which may affect comparability;

b) The financial statements, especially the statement of financial position, present the book value of the entity's resources and obligations, which can be reliably quantified based on the FRS, and do not purport to present the fair value of the entity as a whole. Therefore, the financial statements do not recognize other essential elements of the entity, such as human resources or intellectual capital, the product, the brand, the market, etc.

c) They are based on some estimates and judgments that are made considering the cuts of accounting periods, which is why they do not claim to be exact.

Conclusions

Financial statements, according to the Financial Reporting Standards (NIF), are fundamental tools that offer a structured representation of the financial situation and operating results of an entity.

Their main objective is to provide useful information for economic decision-making by current and potential users, facilitating the evaluation of investments, the granting of credits and administrative performance. In addition, they must include indicators on solvency, liquidity, operational efficiency, financial risks and profitability.

However, financial statements have significant limitations. Variability in the application of accounting standards can affect comparability across entities, and the focus on book value can omit important intangibles, such as human capital and brand. They are also based on estimates and judgments that may not be accurate, highlighting the need for critical analysis when interpreting financial information.

0 comentarios