2024 Working Paper Annual Declaration for Individuals with Business and Professional Activity (to be submitted in 2025)

$799

2024 Work Paper for Individuals with Business and Professional Activity. Includes detailed calculation of annual ISR, monthly tax determination, updated ISR tables and tax compliance checklist. Key tool to optimize the annual declaration and review monthly obligations accurately.

Submit your 2024 financial year annual report in 2025.

El día 30 de abril 2025 es el último día para la presentación de la declaración anual personas físicas con actividad empresarial y profesional del ejercicio 2024.

This Working Paper It is designed to make calculating and filing taxes easier for Individuals with Business and Professional Activity. Includes tools organized into four key sections:

-

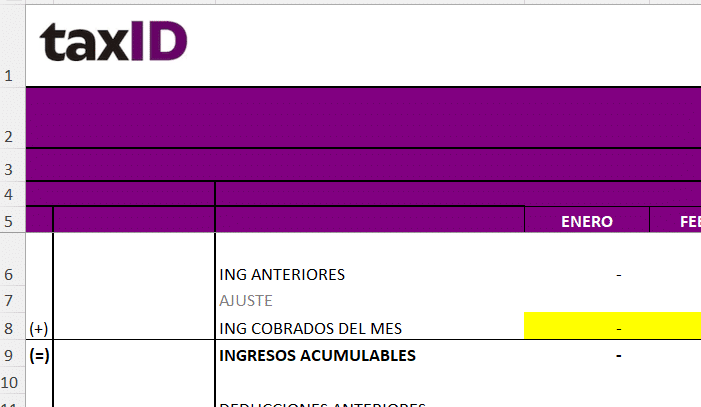

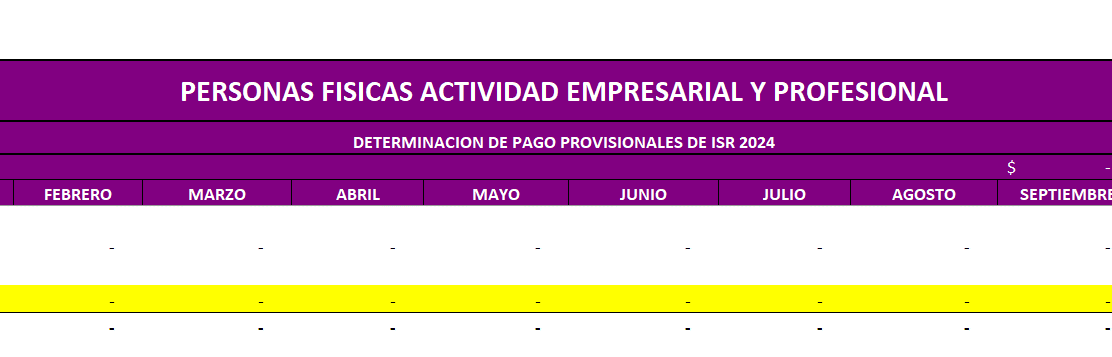

Determination of Monthly Tax - Business and Professional Regime

- Detailed calculation of monthly ISR.

- Identification of income and applicable deductions.

- Determination of provisional payments.

-

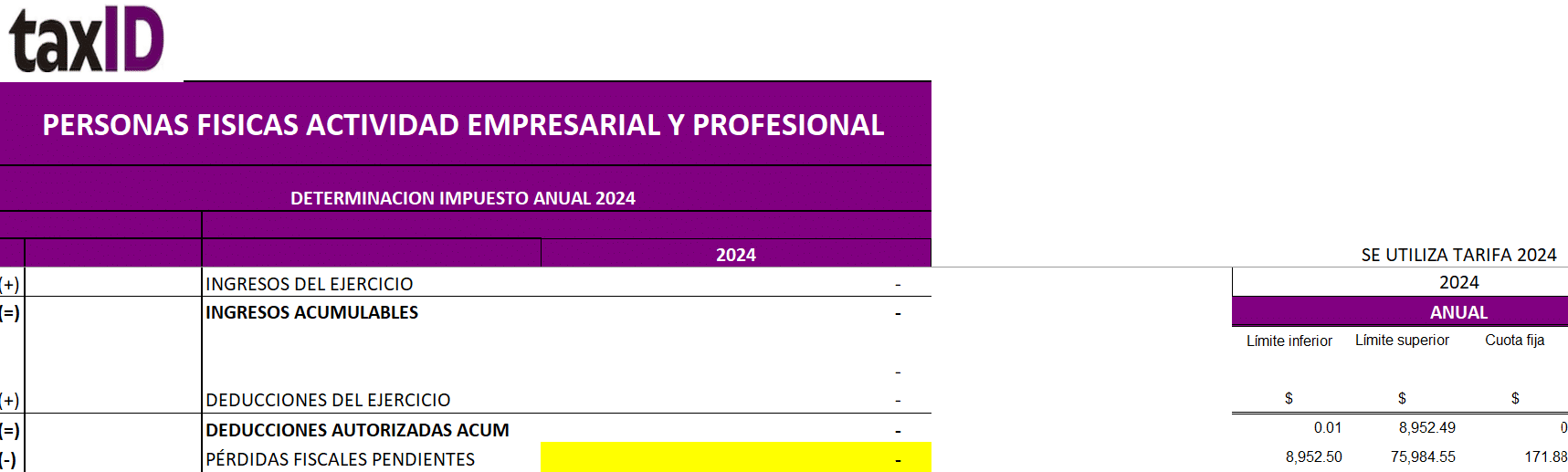

Determination of the Annual Tax - Business and Professional Regime

- Calculation of annual ISR considering accumulated income and authorized deductions.

- Determination of the tax payable or balance in favor.

-

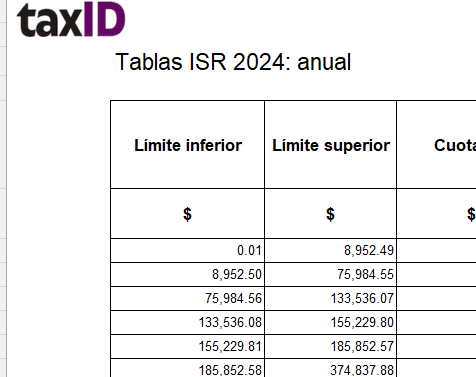

Annual Income Tax Tables (Annual T.)

- Updated tables for calculating annual ISR.

- Correct application of rates and limits established by law.

-

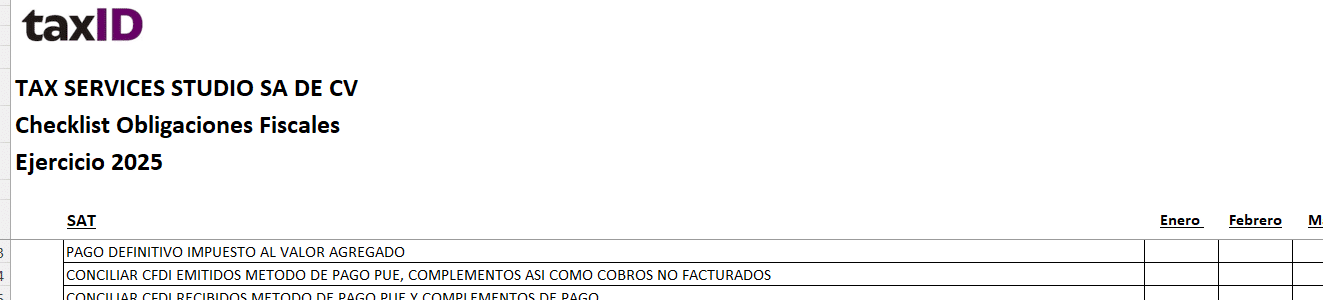

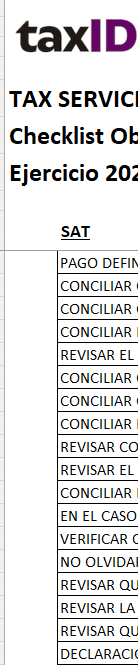

Tax Compliance Checklist

- Review of requirements for filing the annual return.

- Validation of accounting documents and records.

- Monthly application to verify correct compliance with tax obligations.

This format allows you to better organize your calculations and comply with your tax obligations in a timely manner. efficient and precise, both in reviews monthly and annual.

Valoraciones

No hay valoraciones aún.