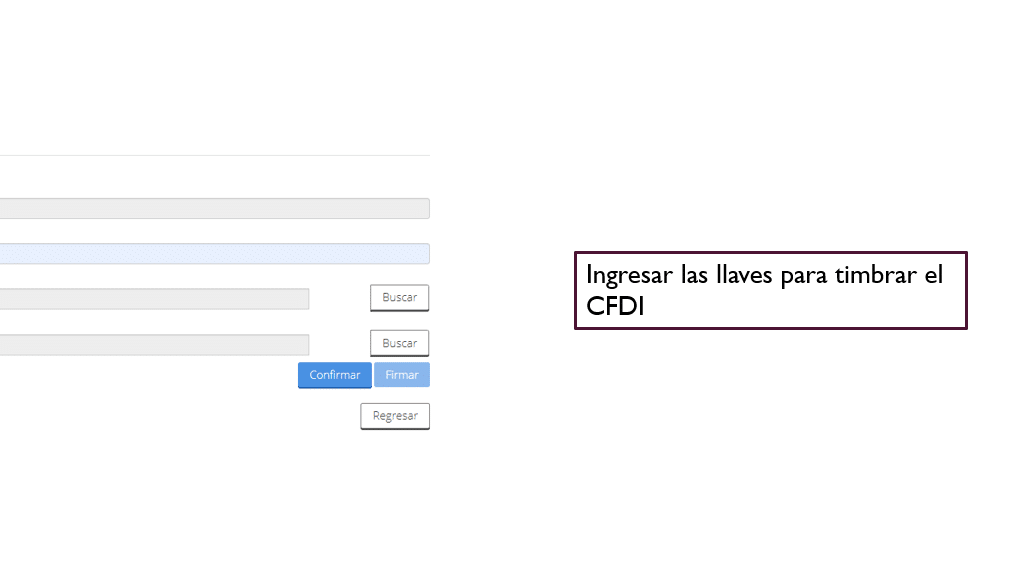

Manual for stamping advances of surpluses for a SC (SAT screens)

$499

PowerPoint guide with screenshots from the SAT for stamping advances or deductible profit balances from provisional payment in civil companies. Easy and up-to-date.

Visual Guide for Stamping Advances and Remaining Profits in Civil Societies

Product description:

This PowerPoint presentation is a detailed visual guide that shows you how to generate the CFDI for the advances or remainders of profits of members of civil societies. With real screenshots from the SAT, this guide is designed for accountants, administrators and members of civil societies who seek to issue CFDI correctly and comply with current tax regulations.

Product characteristics:

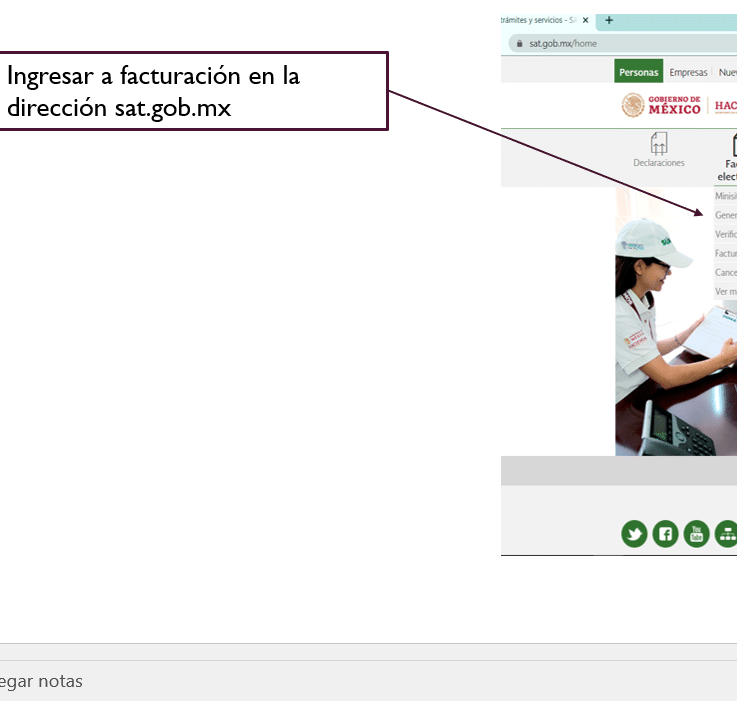

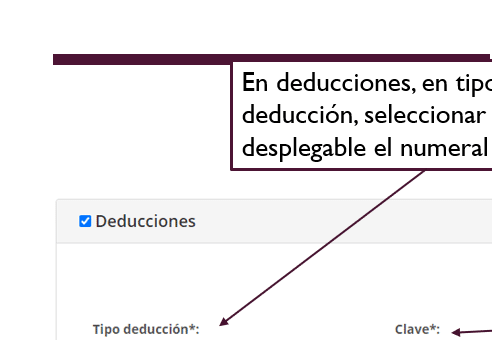

- Step by Step Instructions: Each slide includes screenshots of the SAT portal, clearly and simply showing how to carry out the stamping process.

- Clear Explanations: Detailed descriptions of each step, explaining which options to select and how to fill out the fields for advances or profit carryovers.

- Avoid Common Mistakes: Practical tips to prevent common errors and ensure that the CFDI is deductible from the provisional payment.

- Easy to Use: Simple navigation between steps, allowing quick access to information when you need it most.

- Updated Information: All content is aligned with the latest SAT provisions, ensuring correct and legal stamping.

Benefits of the Guide:

- Comply with your Tax Obligations: Ensures the correct issuance of CFDI for advances and profit balances, deductible from the provisional payment.

- Save Time and Avoid Errors: Complete the process quickly and with fewer complications, avoiding tax problems.

- Ideal for Training: Excellent tool to train new accountants and administrators in the CFDI issuance process.

Who is it for?

- Accountants and tax advisors who manage the accounting and tax aspects of civil companies.

- Managers responsible for the distribution of profits in civil companies.

- Members of civil societies who wish to understand how CFDI are issued for advances or remaining profits.

Optimize your stamping process with this visual guide and comply with tax regulations quickly and easily.

Valoraciones

No hay valoraciones aún.