2025 Batch Load Package for Fiscal Year 2025 and Fiscal Year prior to 2025 (2 files new SAT 2025 platform)

$799

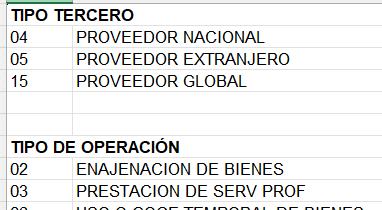

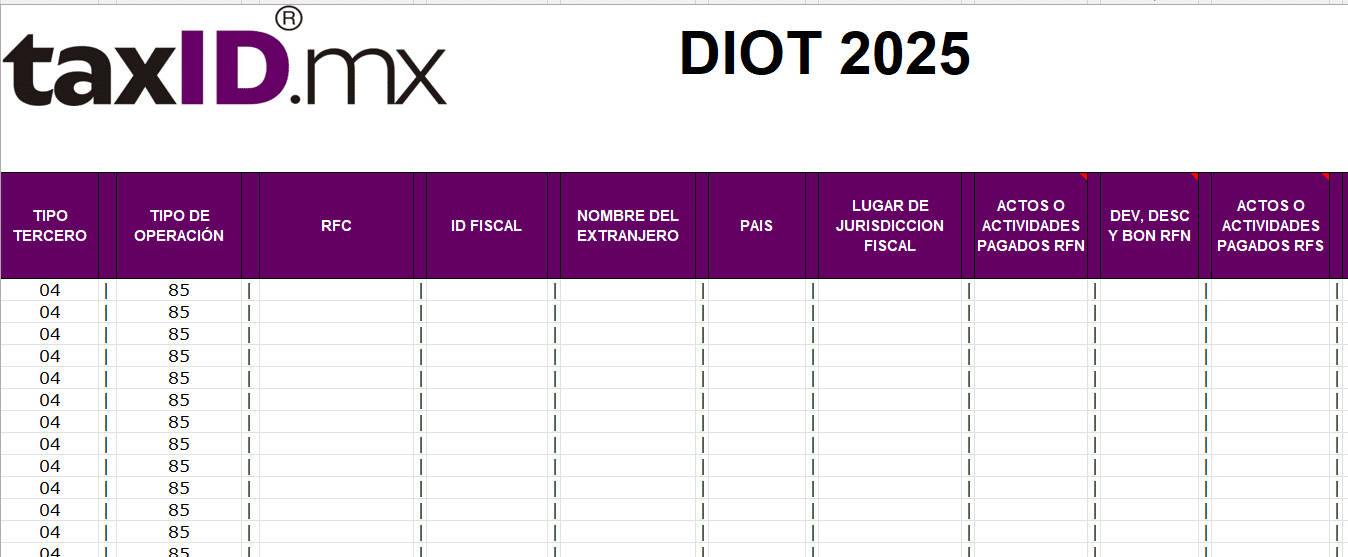

2 Excel formats for your DIOT batch upload, one for fiscal year 2025 and another for fiscal years prior to 2025.

The Tax Administration Service (SAT) has recently implemented significant changes to its portal, affecting the loading mechanics of the Informative Declaration of Operations with Third Parties (DIOT) for the fiscal years 2024 and 2025. To adapt to these new requirements and facilitate compliance with your tax obligations, we present our DIOT 2024 and 2025 Batch Files Package.

Highlighted Features:

-

Archives Updated by Year: The package includes two specific batch files, one for 2024 and one for 2025, each designed according to the latest technical and regulatory specifications established by the SAT for its respective fiscal year.

-

Full Compatibility with the New SAT Portal: Our files are designed to integrate seamlessly with the updated SAT platform, ensuring smooth and efficient loading.

-

Process Automation: Simplify the presentation of the DIOT by avoiding manual data entry. With our batch files, you can upload information in bulk, reducing the time invested and minimizing possible human errors.

-

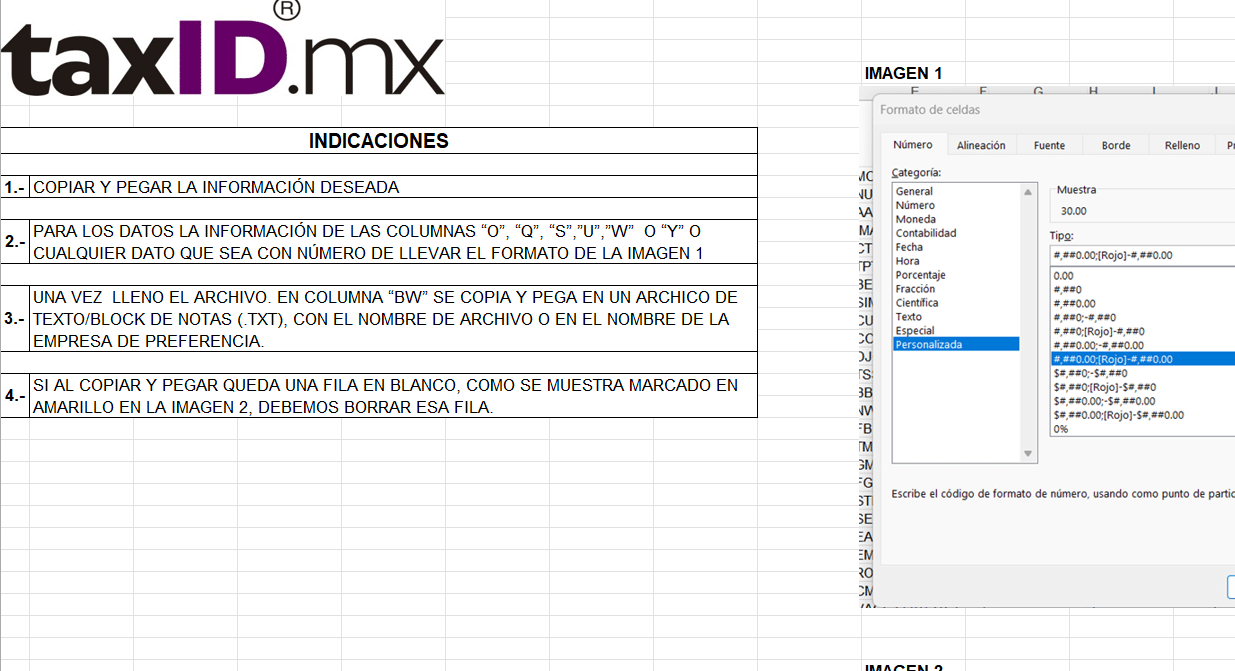

Clear Instructions and Technical Support: Each file comes with a detailed guide that will guide you step by step through the upload process. In addition, we offer technical support to resolve any questions or issues you may face during its implementation.

Additional Benefits:

-

Saving Time and Resources: By automating data loading, you can spend more time on other strategic activities in your business.

-

Secure Compliance with Tax Obligations: Stay up to date with current tax regulations, avoiding potential penalties for non-compliance.

-

Adaptability for Different Types of Taxpayers: Whether you are a freelance accountant, a small or medium-sized business, or a large company, our batch files are tailored to your specific needs.

Why Choose Our DIOT Batch File Package?

Our experience in developing tax tools has allowed us to create practical and effective solutions for our clients. As with our other products, such as the "Working Paper for the Calculation of Personal Taxes"

and the "Hourly Cost Calculator for Accounting Services"

This package has been designed with the goal of facilitating your accounting and tax processes.

Buy Now and Optimize Your Tax Management

Don't let changes in the SAT platform complicate your processes. With our DIOT 2024 and 2025 Batch Files Package, you will be able to adapt quickly and meet your obligations efficiently. Visit our online store at www.taxid.mx/tienda to obtain this and other resources designed to simplify your tax management.

Note: We recommend that you periodically review SAT updates and our communications to ensure that you always have the most recent versions and comply with current requirements.

Valoraciones

No hay valoraciones aún.