Mexico Payroll Calculator 2025

$1,199

Payroll Calculator 2025 in Excel: calculate gross salary, net salary, ISR, IMSS and payroll taxes accurately and customizable. Optimize your payroll management easily!

This Payroll Calculator 2025 is designed to facilitate and automate payroll calculations in companies, accounting firms and human resources professionals. Its intuitive design and complete functionality allow you to perform accurate calculations in accordance with current 2025 regulations, ensuring tax and labor compliance.

You can find out the cost before hiring. Make the right decision.

Main Functions:

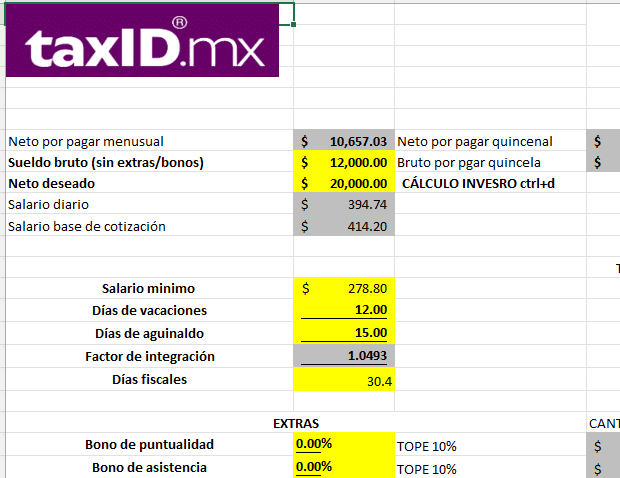

- Determination of Gross and Net Salary:

- Get the gross salary without including additional concepts (bonuses, loans, food vouchers, etc.) by entering the amount in the cell “B8”.

- Automatically calculates net salary, including extras such as punctuality bonuses, attendance, food vouchers and loans.

- Custom Settings:

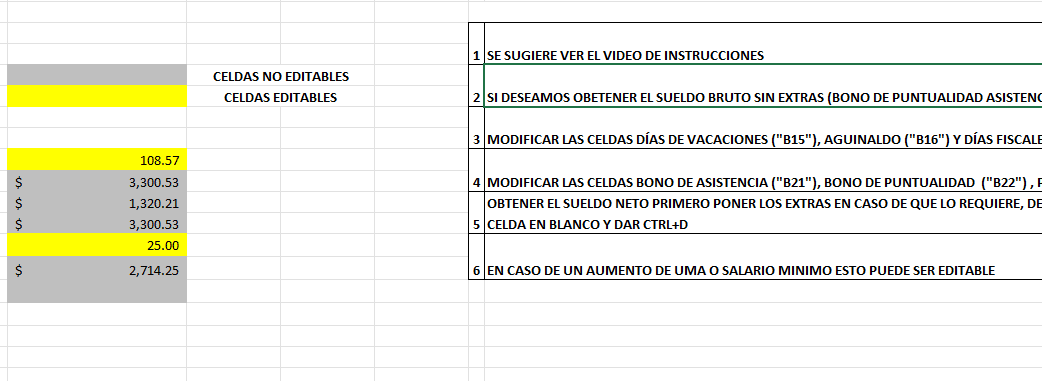

- Modify the parameters of vacation days (cell “B15”), Christmas bonus (cell “B16”) and fiscal days (cell “B18”) to customize calculations according to the conditions of the employment contract.

- Customize additional concepts such as attendance bonus (“B21”), punctuality bonus (“B22”), loans (“B23”) and food vouchers (**“B24” or “B25”).

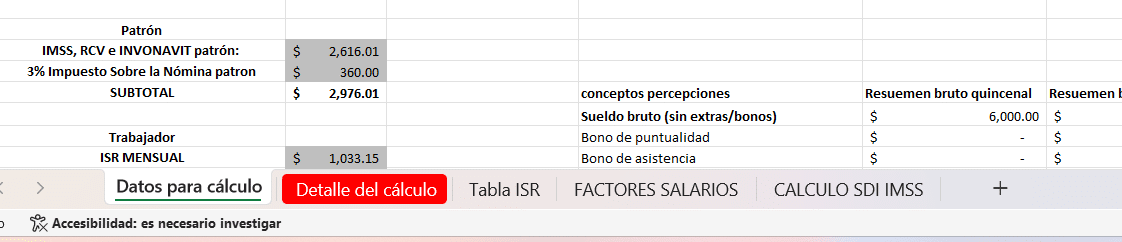

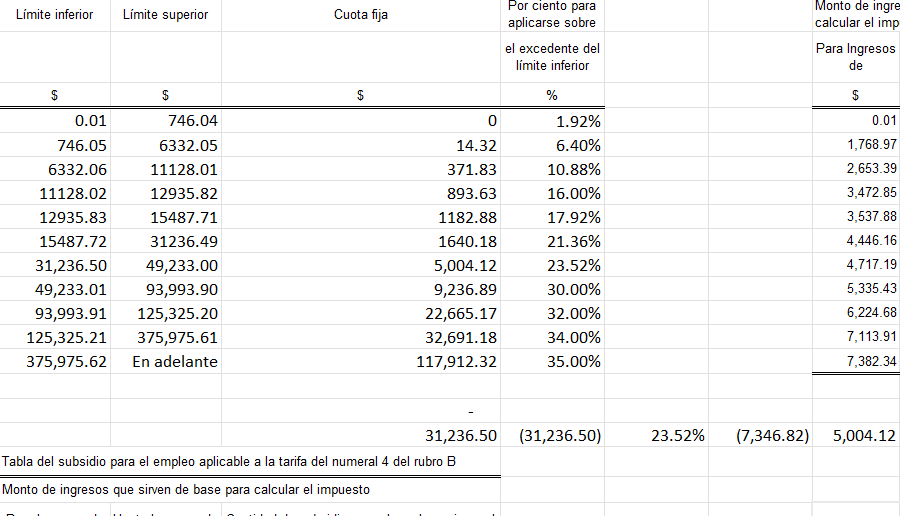

- Detailed Calculations of Tax and Labor Obligations:

- IMSS employer contributions, including detailed breakdowns.

- Income Tax (ISR) with calculation based on the updated tables and rates for 2025.

- Payroll Tax (ISN), adjusted according to the rates applicable in each state.

- Flexible Update:

- Allows modifications to be made in case of increases in the UMA or the minimum wage, adapting to changes in regulations.

- Easy to Use:

- To get the final results, you just need to position yourself on an empty cell and press Ctrl + D, after entering the necessary information.

Benefits of the Calculator:

- Precision: Avoid manual errors and ensure accurate, compliant calculations.

- Time saving: Perform payroll calculations in minutes, without the need for complex formulas.

- Adaptability: Customize parameters such as vacation days, bonuses, and other specific concepts for each worker.

- Tax Compliance: Ensures that tax and fee calculations comply with current Mexican laws.

- Simplicity: Ideal for both accounting experts and users with basic knowledge.

Who Can Use It?

- Accountants and accounting firms that manage company payrolls.

- Human Resources for small, medium and large companies.

- Business owners who want to understand and monitor their payroll calculations.

- Independent professionals in charge of managing payrolls.

Basic Instructions:

- Check out the instruction video included to learn how to take advantage of all the calculator's features.

- Enter the data in the corresponding cells:

- B8: Gross salary without extras.

- B15 to B25: Customize vacation days, Christmas bonuses, bonuses and other concepts.

- Get final results by positioning yourself on an empty cell and pressing Ctrl + D.

Includes:

- Step-by-step instruction video.

- Fully editable Excel template.

- Calculations ready to print and present in labor and tax reports.

Don't waste time with manual and complex processes. With this calculator, you can automate your payroll calculations and focus on other areas of your business. Get the Payroll Calculator 2025 today and take your management to the next level!

Valoraciones

No hay valoraciones aún.