Buy your work papers and receive them instantly in your email, in digital format.

IMSS pension calculator in 2025 (Law 73)

$1,599

The pension calculator estimate the approximate amount of your pension if you contribute under the IMSS Law of 1973To calculate it, you need to know your weeks contributed and the Average daily wage for the last 250 weeks. Check your weeks on the IMSS portal and get a projection of your retirement.

The pension calculator It is a tool designed to help you estimate the approximate amount you could receive at the time of your retirement if you are under the pension system. Social Security Act of 1973.

If you started trading in the IMSS before July 1, 1997Your pension will be calculated based on this system, which takes into account factors such as the total number of weeks of contributions and the average salary of the last years of work.

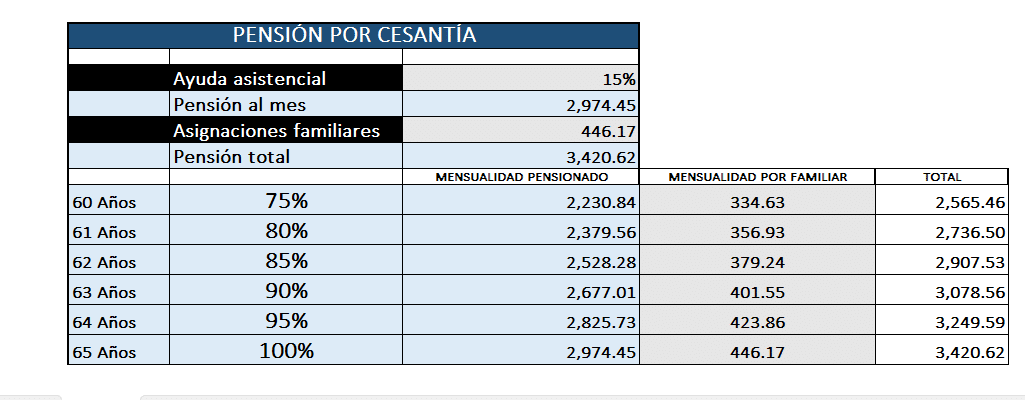

This calculator will allow you to project the amount of your pension in case of retirement due to Layoff at Older Age (from age 60) or Old age (from age 65), considering the criteria established in the IMSS Law of 1973.

What data do you need to calculate your pension?

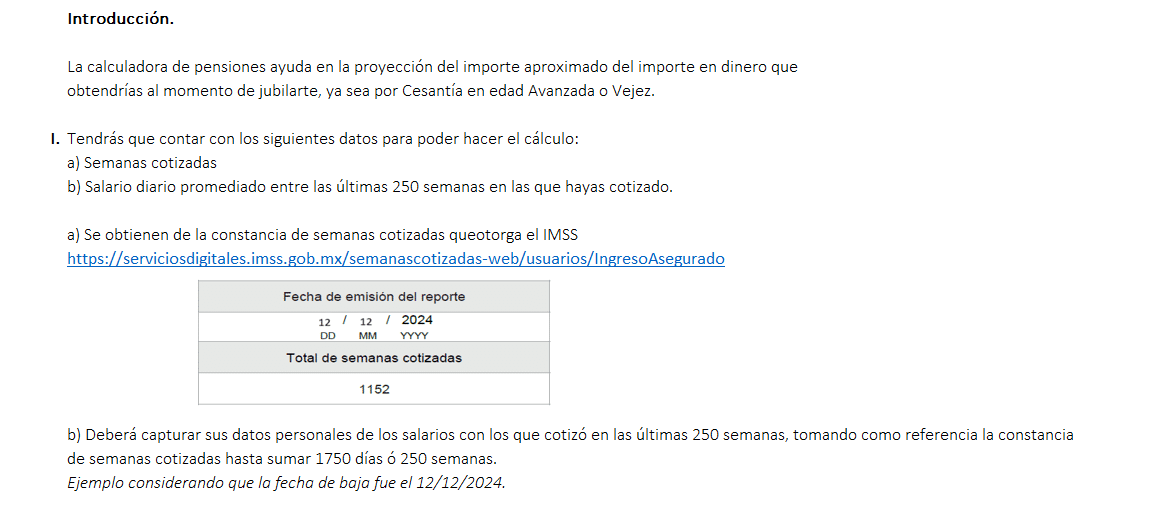

To perform the calculation, it is important to have the following data:

-

Total number of weeks contributed

- It represents the number of weeks you have worked and for which your employer has made contributions to the IMSS.

- To retire under the 1973 Act, you need at least 500 weeks of contributions.

-

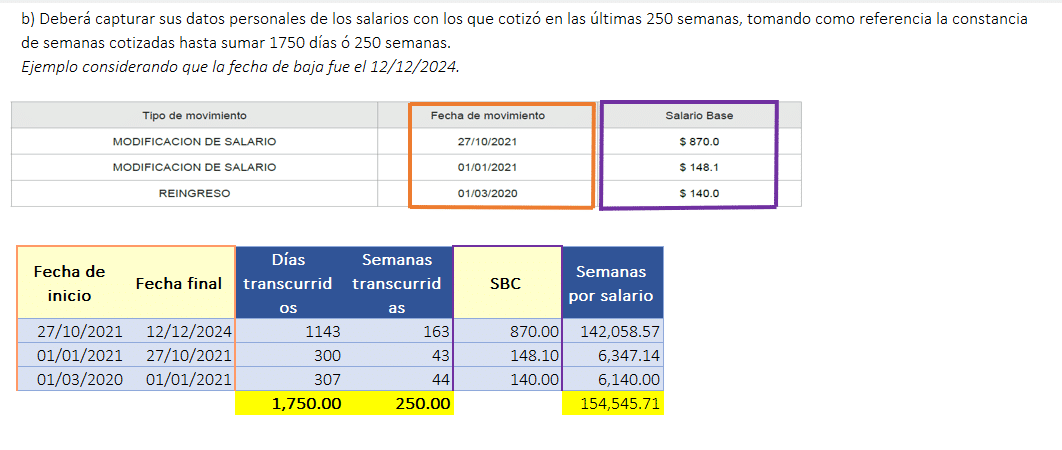

Average contribution base salary

- It is calculated based on the Average of your daily salary in the last 250 weeks of contributions (approximately the last 5 years of work).

- This average is key to determining the amount of your pension, since Law 73 establishes a calculation based on this salary.

How to obtain this data?

To know your weeks contributed and check your contribution history, you can consult your Proof of Contributed Weeks on the official IMSS portal:

Check your contribution weeks here

The system will allow you to download your history and check how many weeks you have accumulated, which will help you determine if you already meet the requirements to retire under this regime.

How does the pension work under the 73 Law?

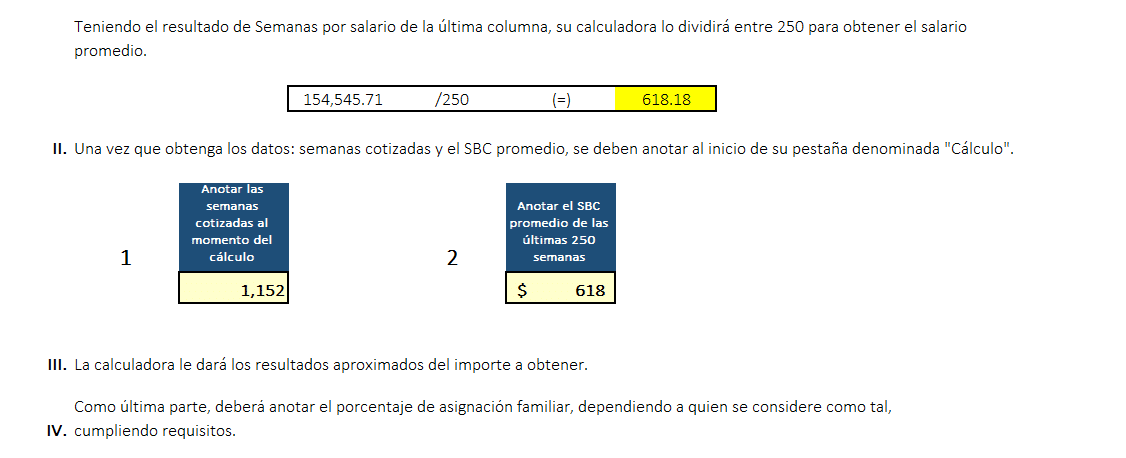

The pension in this regime is calculated based on a Basic Amount plus increases for each additional 52 weeks of contributions, applying a percentage to the average salary. In addition, the final amount will depend on the Measurement and Update Unit (UMA) valid at the time of the pension application.

It is important to consider that, under this law, the pension is granted for life and is entitled to annual updates according to the National Consumer Price Index (INPC).

Conclusion

With this pension calculator, you will be able to obtain a clearer estimate of how much you could receive upon retirement under the 73 Law. This will allow you to plan your financial future more accurately and evaluate whether you need additional strategies to optimize your pension.

If you have questions or need personalized advice, it is advisable to consult with a social security or pension expert.

Trustindex verifica que la fuente original de la reseña sea Google. I’ve been using their service for almost a year, and they’ve been amazing every time! Their team is incredibly knowledgeable about tax laws and always takes the time to explain everything to me in detail. They made the entire process easy and stress-free. Highly recommend them if you're looking for fast, reliable, and professional tax services.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Excelnete despacho, muy profesionales y comprometidos por tenerte al dia en temas contables y fiscales, algo que me encanto es que apuestan a la tecnología para tener mayor alcance.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Excelente despacho de asesoría contable y fiscal. El equipo de Taxid es profesional, eficiente y siempre está disponible para resolver nuestras dudas. Han sido clave en la gestión de nuestra empresa en México. Altamente recomendados.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. TaxID ha sido clave en la estabilidad financiera de la empresa. Su equipo de expertos ofrece un servicio impecable, siempre atentos a los detalles y comprometidos con la tranquilidad fiscal. Gracias a su orientación, hemos optimizado nuestros procesos y cumplido con todas nuestras obligaciones de manera eficiente. Sin duda, su profesionalismo es de alto nivel.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. muy profesionales, un gran equipo y una gran dirección, la verdad altamente recomendados.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Excelente asesoramiento. Me gusto mucho como me ayudaron desde el principio del proceso. Muy recomendados!Publicado enTrustindex verifica que la fuente original de la reseña sea Google. I cannot recommend TaxID highly enough for anyone looking to establish a foreign company in Mexico. Their team has been incredibly efficient and knowledgeable in navigating both Mexican and foreign regulations, ensuring everything was handled with precision and care. The staff is not only highly skilled but also friendly and always willing to go the extra mile to help. What truly sets them apart is their unwavering integrity, which gave us complete confidence throughout the entire process. If you need reliable, expert support in setting up a business in Mexico, look no further than TaxID.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Excellent service from the accounting team. They are always attentive, do everything correctly and on time. They provide support and explanations as needed throughout all processes. I highly recommend them.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Desde hace tiempo me llevan la contabilidad, siempre me explican todo y tienen un excelente servicio.Publicado enTrustindex verifica que la fuente original de la reseña sea Google. Empresa consultora confiable, cumplida y exelente asesoría para empresa Colombiana abriendo sede en México

Productos relacionados

-

Working paper for calculating taxes for individuals with business and professional activity

Valorado con 5.00 de 5$299 -

Comprehensive income statement (Excel)

$299 -

¡Oferta!

New DIOT 2025 Batch Load

$699El precio original era: $699.$499El precio actual es: $499. -

¡Oferta!

All papers for individuals

$30,000El precio original era: $30,000.$6,999El precio actual es: $6,999.

Valoraciones

No hay valoraciones aún.