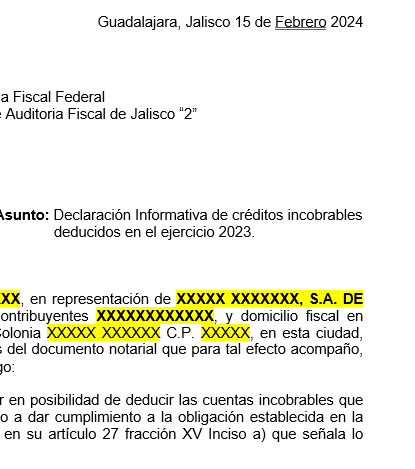

Free letter to inform the SAT about the deduction of uncollectible accounts

$199

Facilitate tax compliance with this pre-formatted document to inform the SAT about the deduction of uncollectible accounts in accordance with current legislation.

This written format is designed to notify the SAT about the deduction of uncollectible accounts in a clear and precise manner. It is an indispensable tool for companies and individuals who wish to comply with the tax requirements established in article 27 of the Income Tax Law (ISR).

The document includes:

- A professional structure to ensure acceptance by the SAT.

- Editable fields to customize it to the needs of your company or client.

- Detailed instructions for completing and submitting the document.

Benefits:

- Save time and avoid errors when preparing the document.

- Comply with current tax regulations in a simple way.

- Reduction of tax risks by having a well-prepared document.

It is ideal for accountants, tax specialists and companies that wish to streamline their tax management in a professional manner. Simplify the process and ensure compliance with the SAT!

Valoraciones

No hay valoraciones aún.