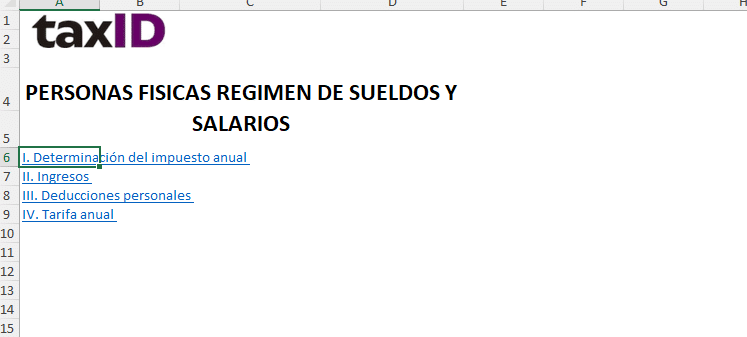

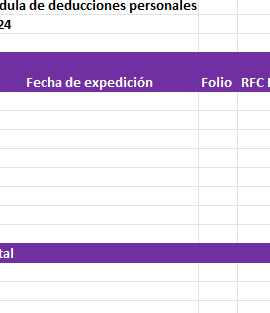

Working Paper for the 2024 Annual Declaration of Individuals (Salaries and Wages, to be Submitted in 2025)

$499

Excel tool for calculating and documenting the 2024 annual tax return for individuals with income from salaries and wages. Ideal for filing with the SAT in April 2025 or later, as well as for manually integrating the calculation and supporting it in case of a request or rejection.

Working Paper Annual Declaration 2024 – Individuals Salaries and Wages (Presentation in 2025)

This Excel file is designed to help you prepare, calculate and document your Annual Declaration 2024 accurately, complying with the tax obligations that must be submitted to the SAT no later than April 30, 2025.

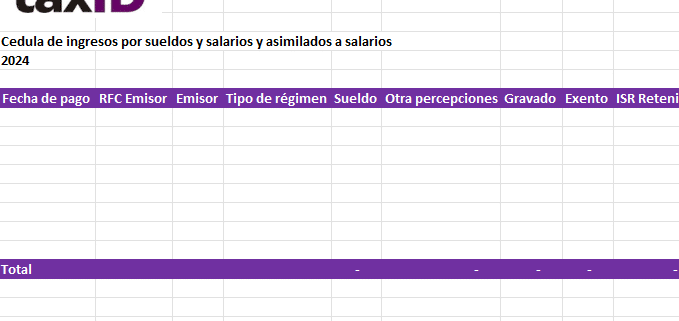

Ideal for individuals with the salary and wage regime and assimilated to salaries, this work paper It also serves as documentary support in case the SAT rejects your declaration and requests you the calculation of ISR and integration of accumulative income and personal deductions.

Includes:

-

Income integration format.

-

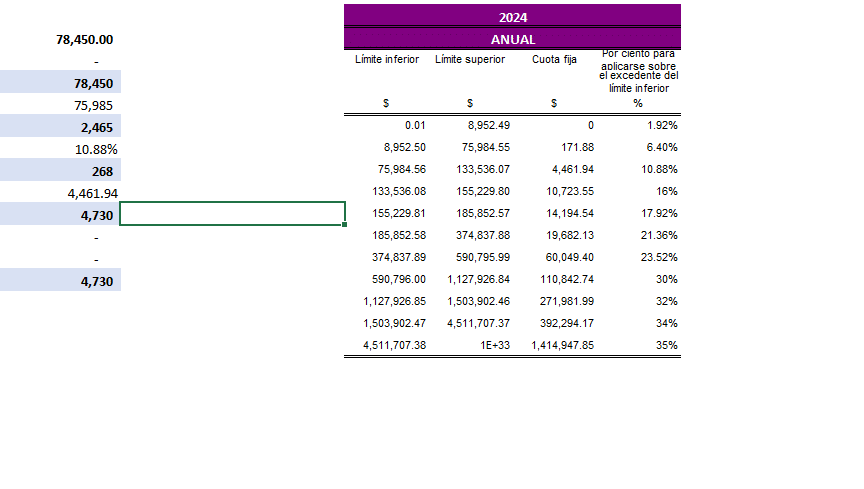

Automatic calculation of annual ISR.

-

Space to record personal deductions.

-

Reconciliation sheet between accruable income and CFDI.

Utility:

-

It serves as support in case the SAT requests the integration of personal income and deductions.

-

Useful if your refund is rejected and you need to check your calculation.

-

Ideal for filing with the SAT in April 2025 or later.

Important:

-

Corresponds to fiscal year 2024.

-

You can use it for the RFC you need (it is not restricted to a single taxpayer).

-

It's a fully editable Excel file: you can modify, adapt, and copy it as many times as you like for different records or taxpayers.

Note: It's not an automatic SAT form. It's an accounting and tax tool that facilitates the preparation and documentation of annual calculations.

Valoraciones

No hay valoraciones aún.