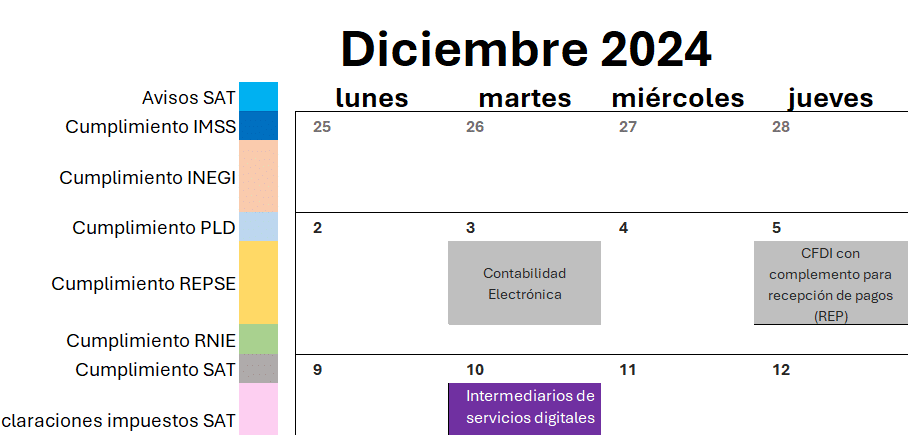

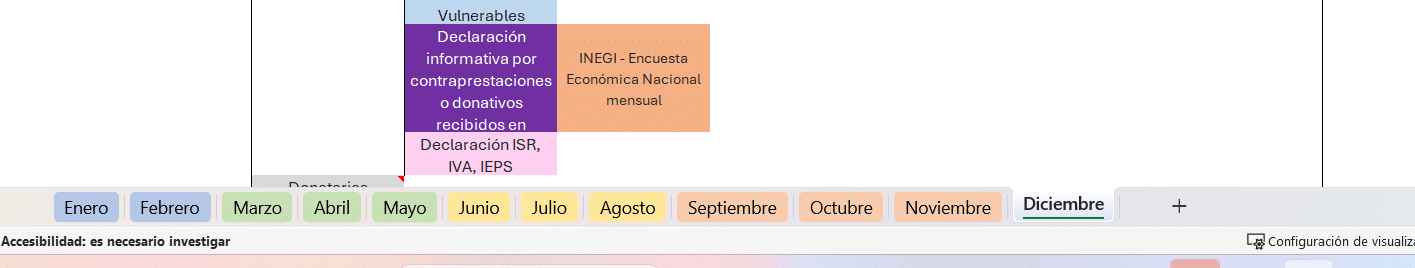

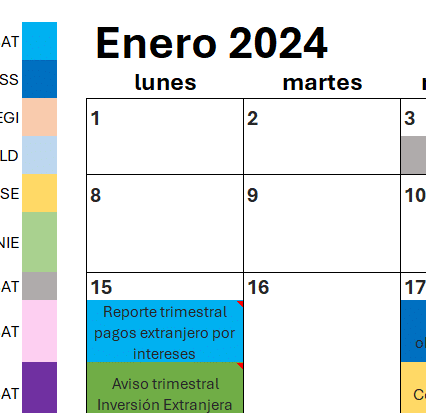

2024 Fiscal Calendar

$299

An essential tool to manage key dates for your tax and administrative obligations, including SAT, IMSS, INEGI, PLD, REPSE and more. Keep everything up to date easily!

Mexico Fiscal Calendar: Key Obligations

This Tax Calendar is an essential tool for any company or individual in Mexico, as it includes all the key dates related to the main fiscal and administrative obligations of the year. Stay up to date and avoid penalties with a detailed follow-up of each of your responsibilities. Among the obligations included are:

- SAT Notices: Dates for submitting various notices and notifications to the Tax Administration Service (SAT).

- IMSS compliance: Deadlines for submitting obligations to the Mexican Social Security Institute, such as payment of fees.

- INEGI compliance: Declaration of mandatory statistical data before the National Institute of Statistics and Geography.

- AML Compliance: Compliance with regulations related to the Prevention of Money Laundering.

- REPSE compliance: Registration and updating in the Registry of Providers of Specialized Services or Specialized Works.

- Compliance with the RNIE: Submission of information to the National Registry of Foreign Investments.

- SAT statements: Dates to comply with monthly and annual tax returns to the SAT.

- SAT information statements: Information obligations to be submitted to the SAT.

With this calendar, you will have a clear vision of when and how to fulfill each of these responsibilities, allowing you to plan ahead and always stay on track.

Valoraciones

No hay valoraciones aún.