Checklist for accounting and tax closing in Excel

$399

Excel checklist for accounting and tax closing, covering taxes, withholdings, payrolls and more, to ensure an efficient and error-free process.

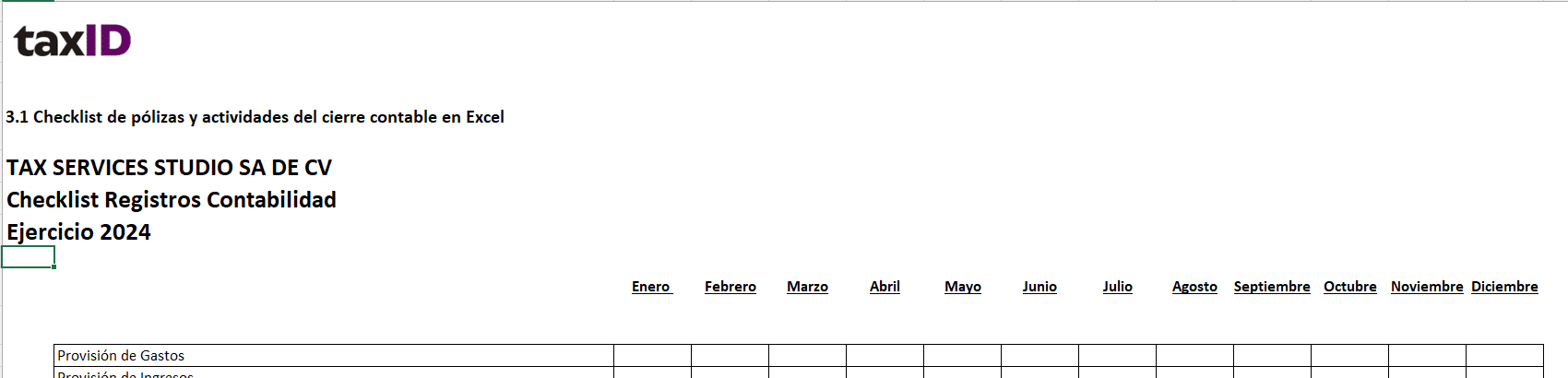

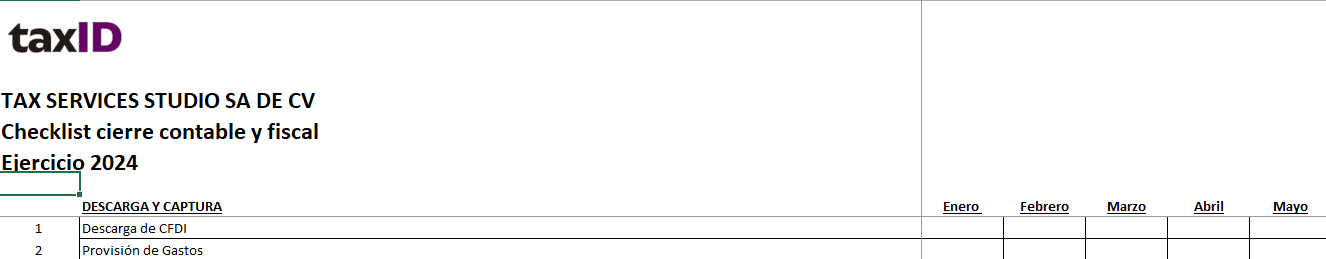

This Excel checklist is a comprehensive tool designed to ensure an accurate and smooth accounting and tax closing. Ideal for accountants and managers, this resource covers all the key areas that require attention at the end of the fiscal year. Some of the sections included are:

- Taxes: Verify compliance with all tax obligations, including the declaration and payment of federal and local taxes.

- Income tax withholdings: Ensures that income tax withholdings from employees, suppliers and third parties are correctly calculated and recorded.

- VAT withholdings: Control the VAT withholdings applied in operations with suppliers and check that they are correctly registered.

- IEPS withholdings: Evaluates and confirms the applicable IEPS withholdings in the corresponding cases.

- Informative: Includes a guide for the preparation and submission of information returns such as the DIOT and other periodic obligations.

- Notices: Keep up to date with all required notifications to the tax authorities, such as changes in tax status or filing of offset notices.

- Activities: Monitor and verify all accounting activities required for closing, from bank reconciliation to account cleansing.

- Tax Mailbox: Ensures that all messages and notifications received in the SAT Tax Mailbox are reviewed and attended to.

- Payrolls: Confirms the correct calculation and registration of payrolls, as well as the submission of the corresponding declarations to the IMSS and INFONAVIT.

- Department of Labor: Verifies compliance with obligations before the Ministry of Labor and Social Security (STPS), such as the presentation of the annual declaration of the work risk premium.

- List of Accounting Records: Review and adjust all accounting records, ensuring that financial information accurately reflects the reality of the company.

This checklist is a practical and comprehensive guide that will allow you to carry out the accounting and tax closing in an organized manner, avoiding omissions and ensuring compliance with all legal obligations. Save time and minimize errors with this essential tool for the annual closing.

Valoraciones

No hay valoraciones aún.