Depreciation calculator in excel

$499

Download this Excel tool to calculate tax depreciation and its update according to the INPC. Automate your calculations and easily comply with tax regulations.

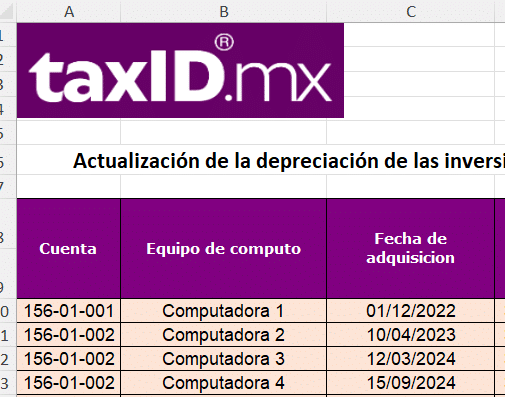

Optimize and automate the calculation of tax depreciation with this Excel tool. Designed specifically for accounting professionals and business owners, this template will allow you to calculate the tax depreciation of assets quickly, accurately and in compliance with the current tax provisions in Mexico.

Main features:

- Automatic depreciation calculation: Apply the tax depreciation rates established under the Income Tax Law (ISR).

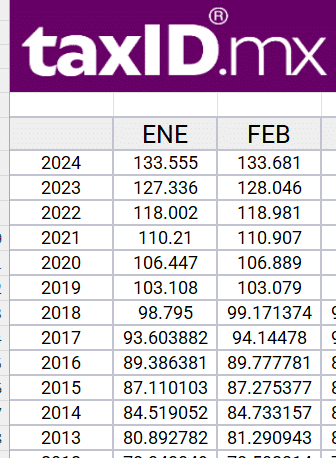

- Values update: Includes formulas for updating asset values, considering the National Consumer Price Index (NCPI).

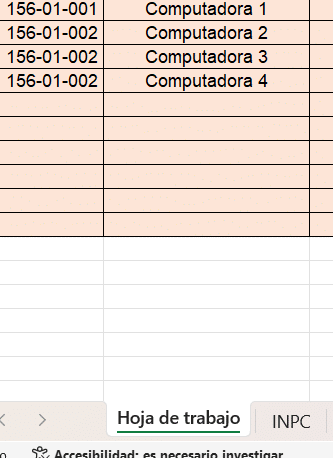

- Intuitive organization: Classifies assets by type and category, facilitating monitoring and control.

- Regulatory compliance: Correctly calculate tax deductions for your assets, ensuring alignment with tax regulations.

- Easy customization: Adapt the template to the specific needs of your company or clients.

Benefits:

- Time saving: Automate complex calculations and reduce human errors.

- Greater precision: Comply with tax regulations without complications.

- Total control: Keep a clear and orderly record of assets and their depreciation.

Ideal for accountants, business owners and anyone who needs to efficiently control tax depreciation. Discover how this tool can simplify your administrative workload and improve your tax compliance.

Get it now and take your tax calculations to the next level.

Valoraciones

No hay valoraciones aún.