Working paper Annual Declaration 2024 General Regime for Legal Entities (SAT)

$999

Working paper for the 2024 Annual Declaration of Legal Entities under the General Regime. Compatible with the SAT simulator of December 20, 2023.

Receive a 10% discount on purchases over $1000

"Learn how to use the worksheet in this video tutorial"

Working Paper for Annual Declaration 2024 - General Regime for Legal Entities

With this updated working paper, you will be able to complete the 2024 Annual Declaration of Legal Entities under the General Regime in an efficient and accurate manner. This product is designed based on the current tax provisions and the SAT simulator released on Friday, December 20, 2024, ensuring maximum compatibility with official tools.

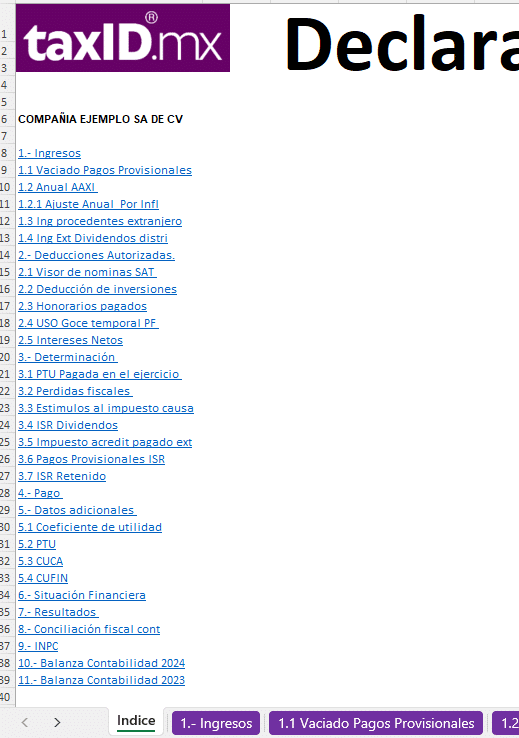

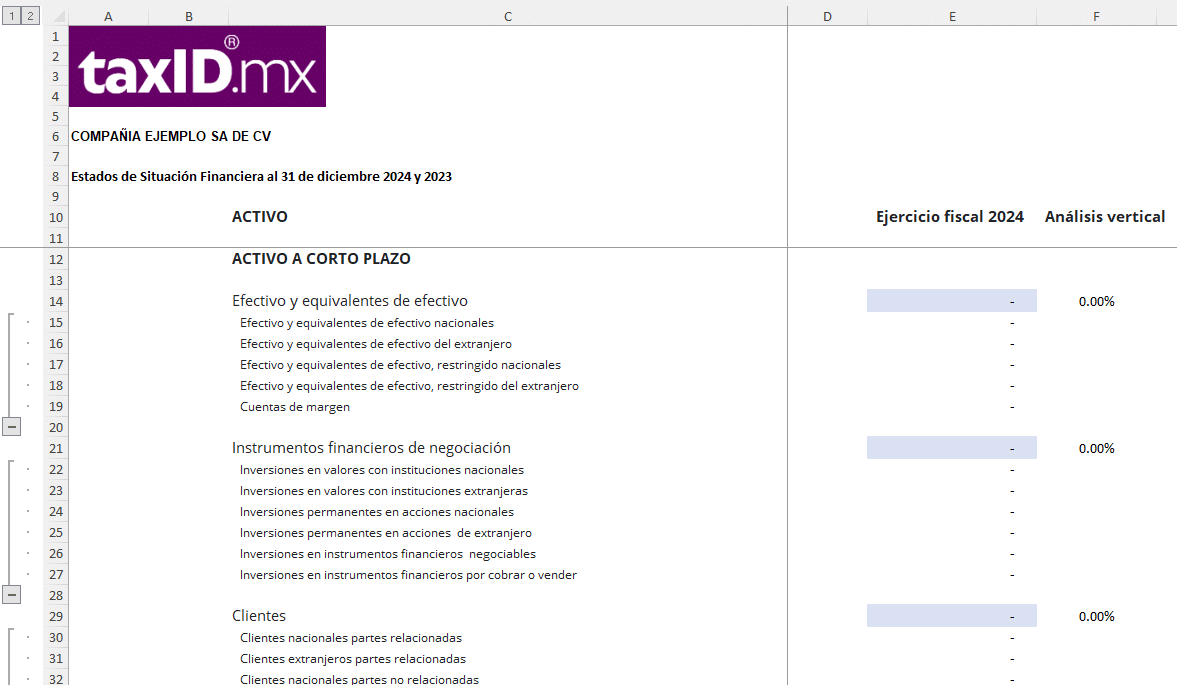

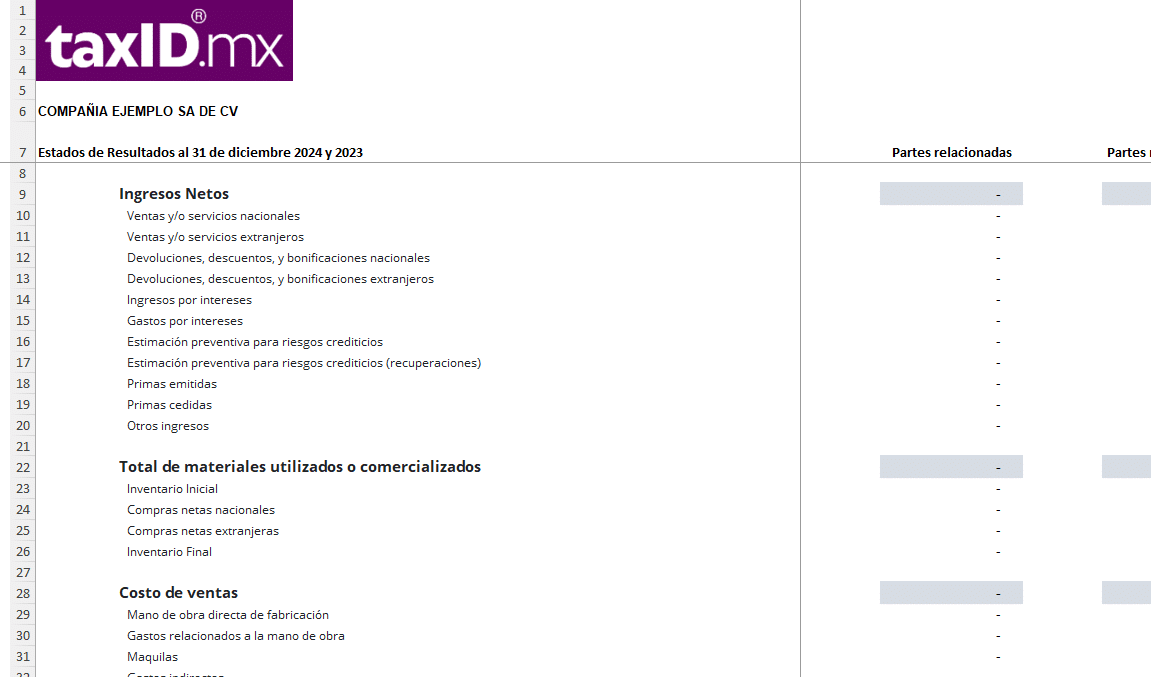

Working Paper Index:

- Income

1.1 Clearing Provisional Payments

1.2 Annual AAXI

1.2.1 Annual Adjustment for Inflation

1.3 Income from abroad

1.4 Ext Income Dividends Distributed - Authorized Deductions

2.1 SAT Payroll Viewer

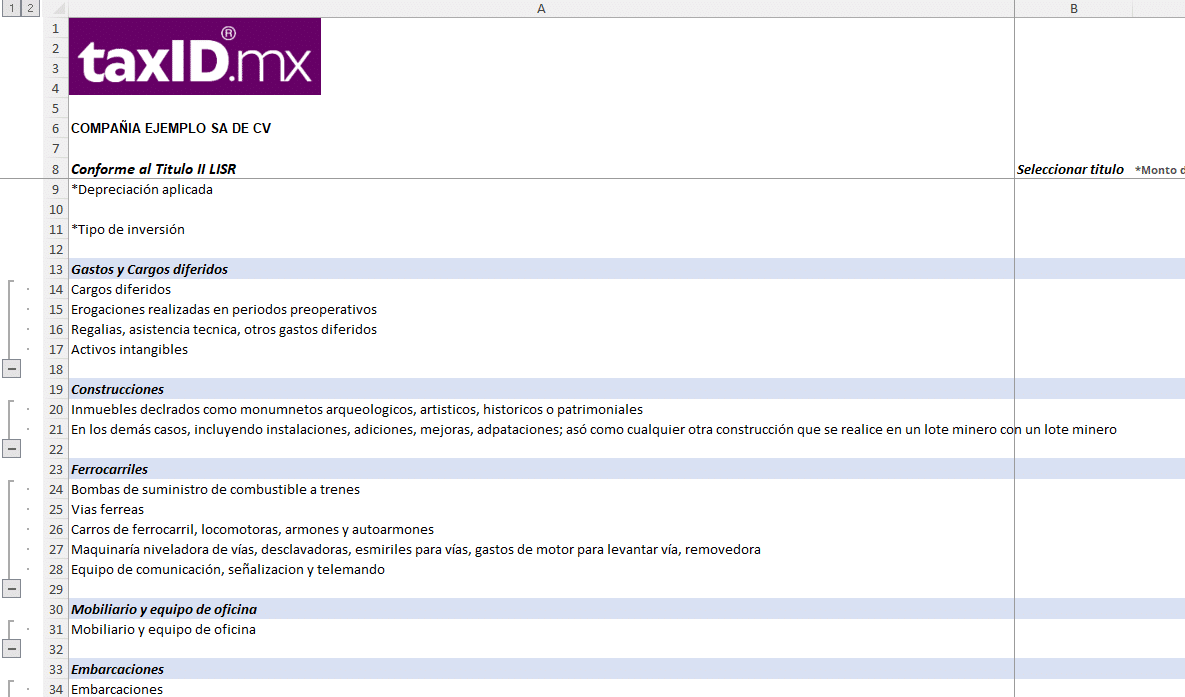

2.2 Investment Deduction

2.3 Fees Paid

2.4 Temporary Use or Enjoyment of PF

2.5 Net Interests - Determination of ISR

3.1 PTU Paid in the Fiscal Year

3.2 Tax Losses

3.3 Incentives to Tax Caused

3.4 ISR on Dividends

3.5 Tax Credited Paid Abroad

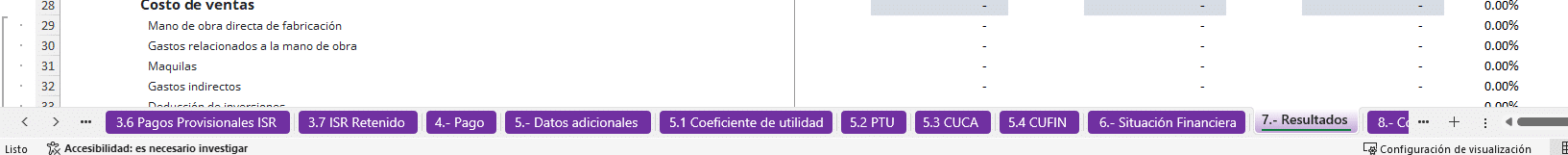

3.6 Provisional ISR Payments

3.7 ISR Retained - Payment of ISR

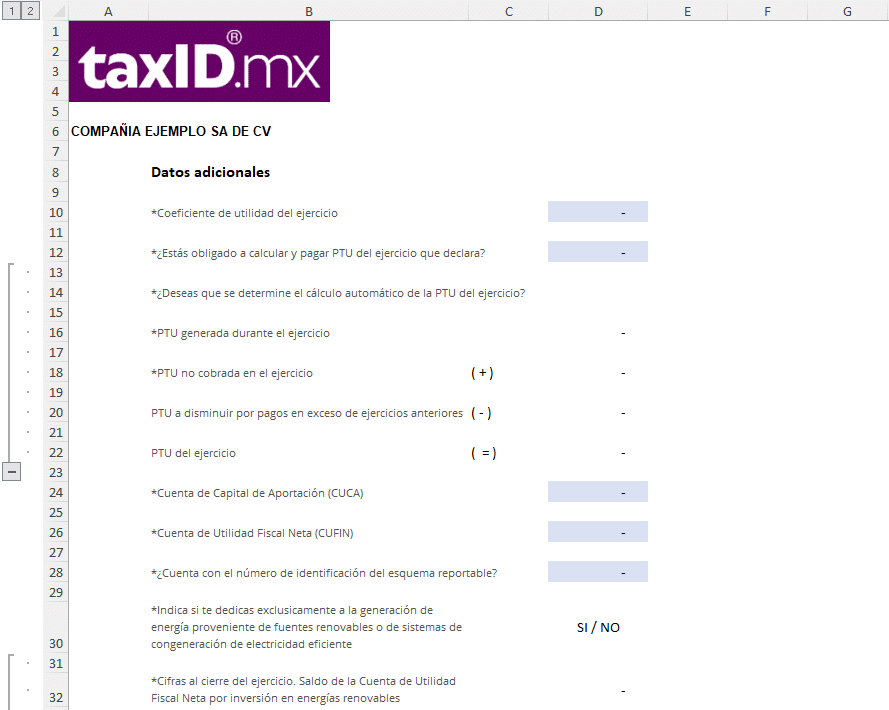

- Additional Data

5.1 Utility Coefficient

5.2 PTU

5.3 CUCA

5.4 CUFIN - Financial situation

- Results of the Exercise

- Accounting Tax Reconciliation

- INPC

- Accounting Balance Sheet 2024

- Accounting Balance Sheet 2023

Key Benefits:

- Automated calculations: Reduce errors and simplify the preparation process.

- Detailed and organized structure: Address each section of the annual return clearly.

- Compliance with current regulations: Designed in accordance with the most recent published tax provisions.

This work paper is ideal for accountants and companies looking to simplify their annual filing process while ensuring tax accuracy and compliance. Prepare yourself now with the most reliable tools on the market.

Valoraciones

No hay valoraciones aún.