ISR Working Paper and Monthly Advances 2024 for Civil Societies (SC) (Title II)

$999

Comprehensive worksheet for Civil Societies 2024, which facilitates the calculation of ISR, monthly advances, and tax adjustments, including accounting records and reconciliations.

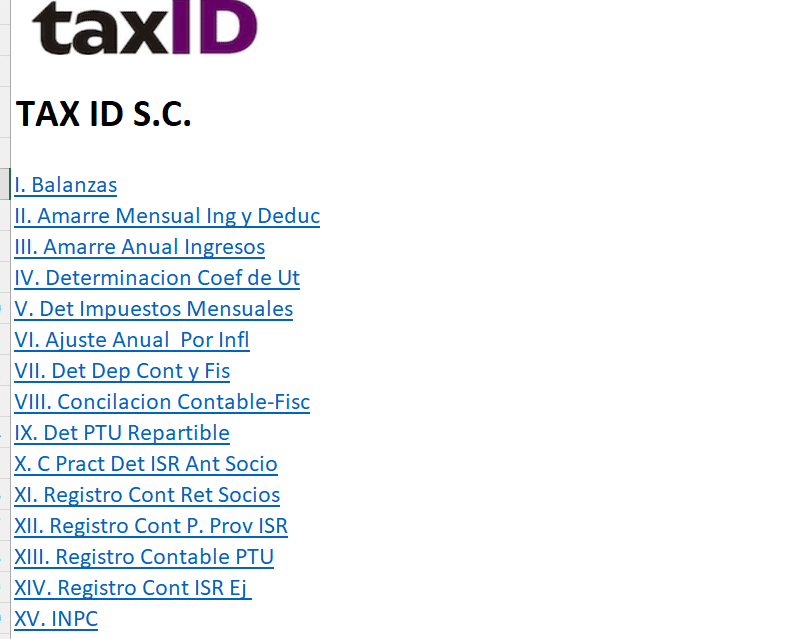

This working paper is a comprehensive and detailed tool designed to assist Civil Societies (CS) in determining ISR and advances on monthly profits during fiscal year 2024. The content is organized into the following sections:

- Scales: Analysis and reconciliation of trial balances, essential to ensure the accuracy of accounting information.

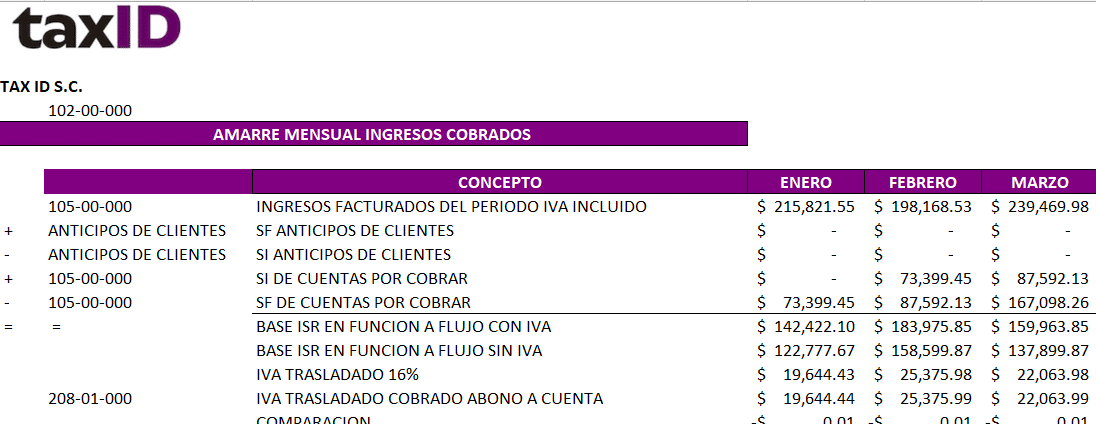

- Monthly Income and Deductions Schedule: Monthly verification of consistency between recorded income and deductions, ensuring that they are adequately reflected in the financial statements.

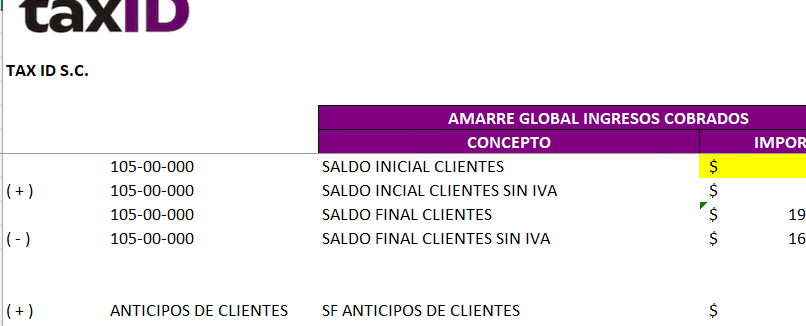

- Annual Income Tie-Up: Annual reconciliation of income, ensuring that all income for the year is correctly accounted for.

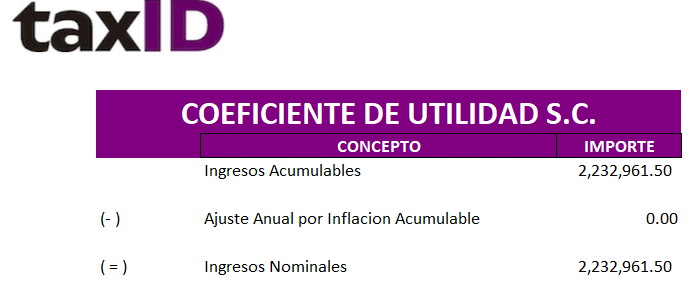

- Determination of the Utility Coefficient: Calculation of the utility coefficient based on the results obtained, necessary for determining the ISR and advance payments.

- Monthly Tax Determination: Detailed calculation of taxes to be paid monthly, considering income and applicable deductions.

- Annual Inflation Adjustment: Adjustments required at the end of the financial year due to inflationary effects, in accordance with current tax regulations.

- Accounting and Tax Depreciation Detail: Analysis of depreciation in both accounting and tax terms to ensure its correct application and registration.

- Accounting-Tax Reconciliation: Reconciliation between accounting records and tax obligations, to ensure that there are no discrepancies.

- Determination of Distributable PTU: Calculation of the amount of Employee Profit Sharing (PTU) to be distributed among the partners, complying with labor obligations.

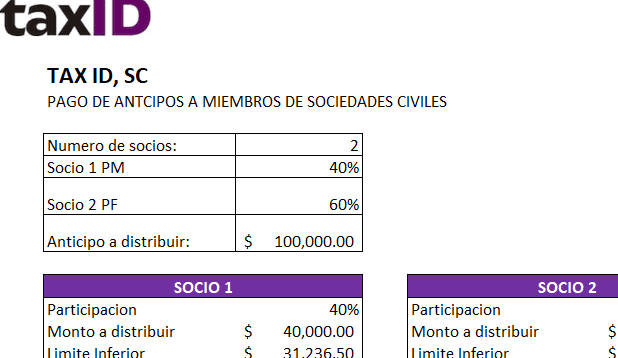

- Practical Calculation for Determining Income Tax for Advance Payment to Partners: Tool to practically calculate the ISR corresponding to advances to partners.

- Accounting Record of Withholdings from Partners: Detailed accounting record of income tax withholdings applied to partners.

- Accounting Record of Provision for Income Tax: Registration and accounting provision for ISR, ensuring that future tax obligations are correctly considered.

- Accounting Record of the PTU: Accounting entry for PTU, which allows for precise control of this concept in the financial statements.

- ISR Accounting Record for the Fiscal Year: Income tax registration for the fiscal year, ensuring its correct application in accounting.

- National Consumer Price Index (NCPI): Inclusion of the INPC values necessary for fiscal and accounting adjustments related to inflation.

This working document is an indispensable tool for any Civil Society seeking to comply with its tax obligations in an organized and efficient manner.

Valoraciones

No hay valoraciones aún.