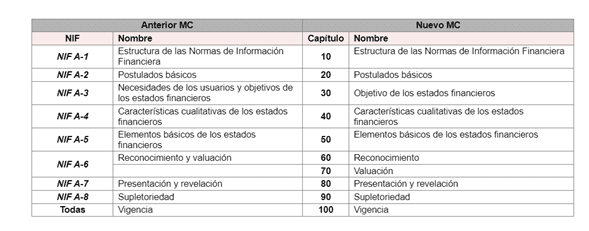

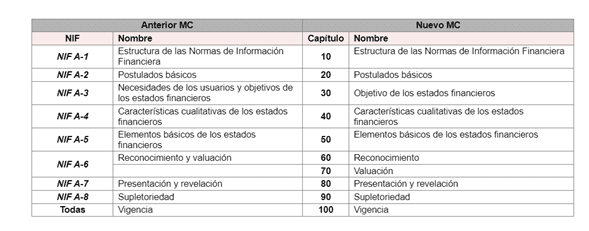

New NIF Series A Conceptual Framework (2024)

The objective of Series A of the NIF is to define and establish the Conceptual Framework that supports the particular NIFs and the resolution of issues that arise in the accounting recognition of transactions and any events that economically affect the entity. The...

New NIF Series A Conceptual Framework (2024)

The objective of the NIF Series A is to define and establish the Conceptual Framework that supports the specific NIFs and the solution to problems that arise in the accounting recognition of transactions and any event that economically affects the...

What is Bank Reconciliation and its relevance in Mexico?

Bank reconciliation is a fundamental accounting process that allows a company's financial records to be compared with the data provided by the bank. This exercise is essential to ensure that both records match and, in the event of discrepancies, to correct the...